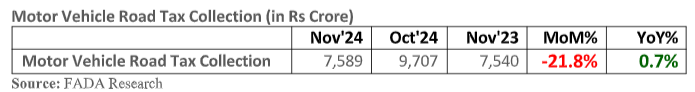

The Federation of Automobile Dealers Associations (FADA) released its November 2024 Vehicle Retail Data, offering a detailed analysis of the automotive retail market. The month saw mixed performances across segments, with some categories showing growth while others faced headwinds.

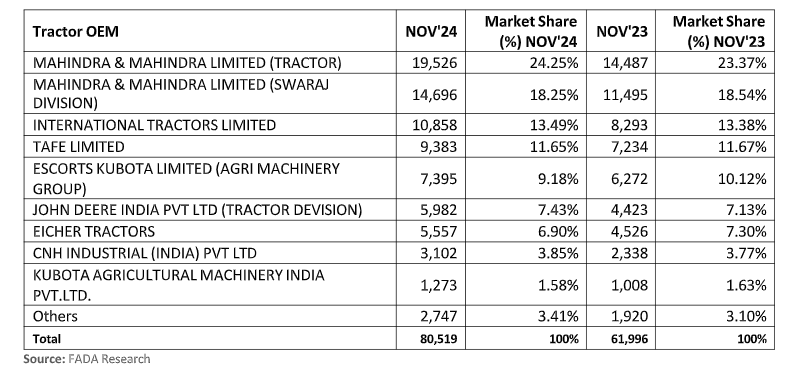

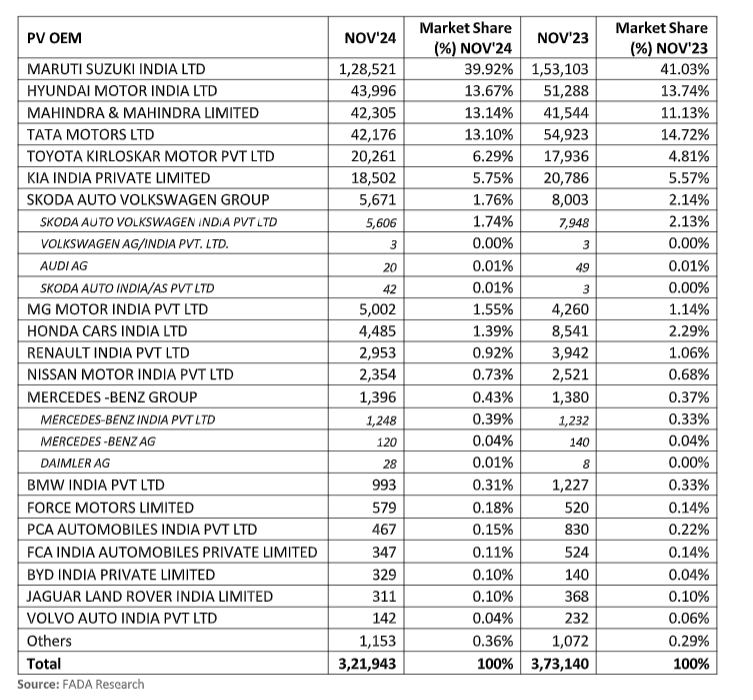

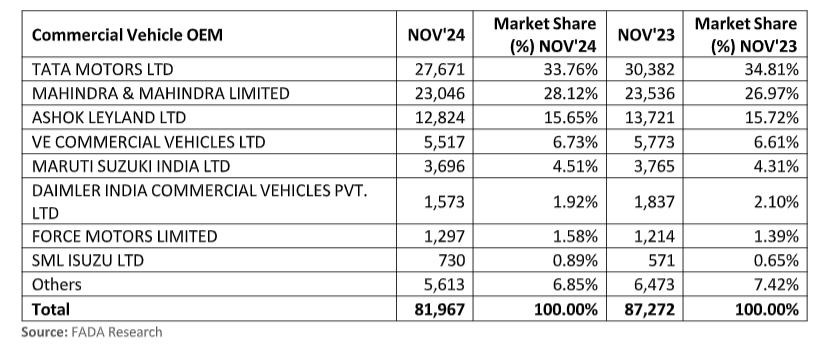

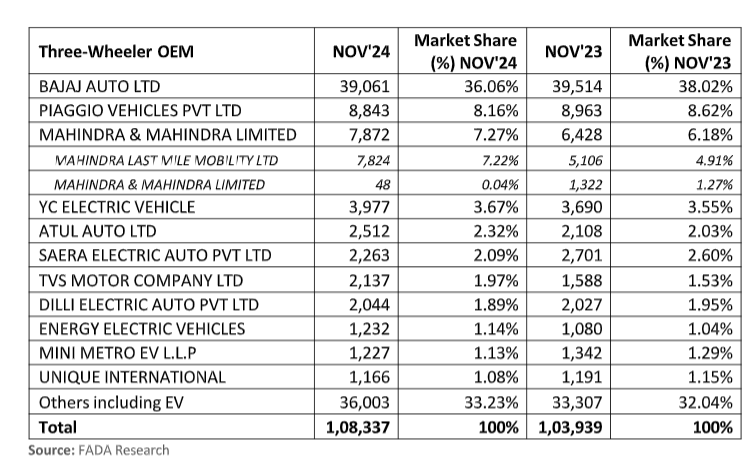

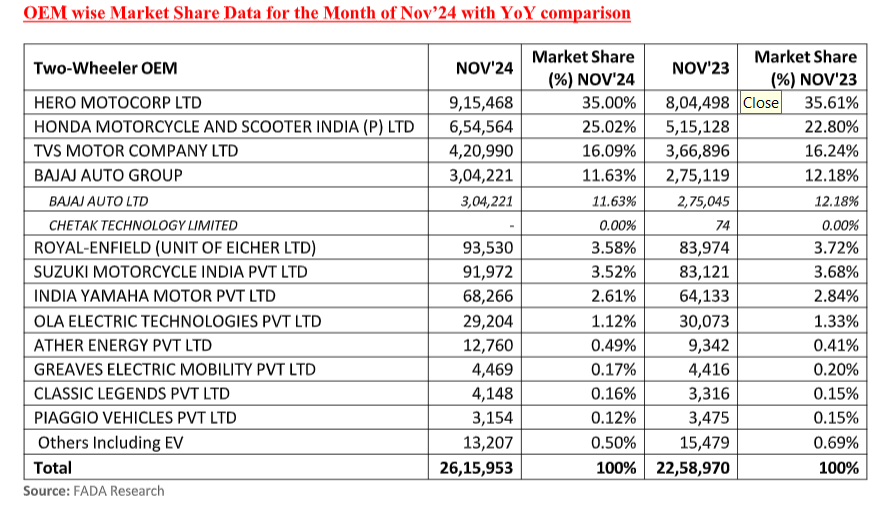

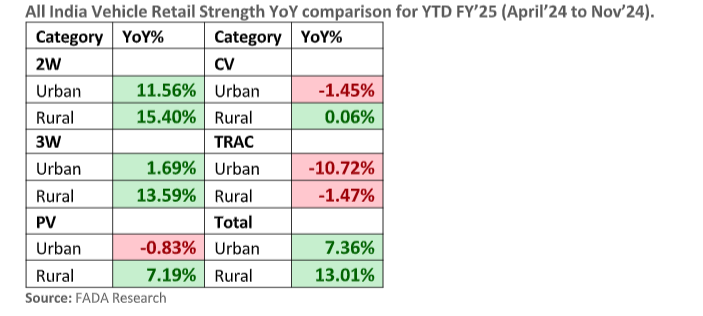

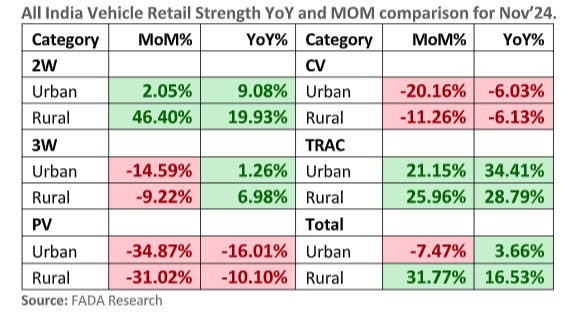

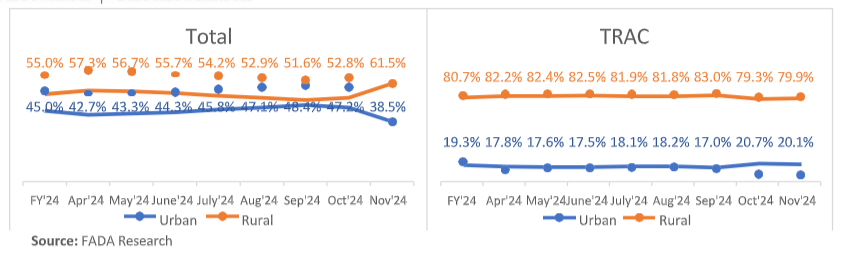

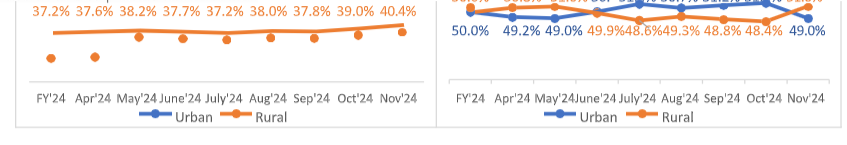

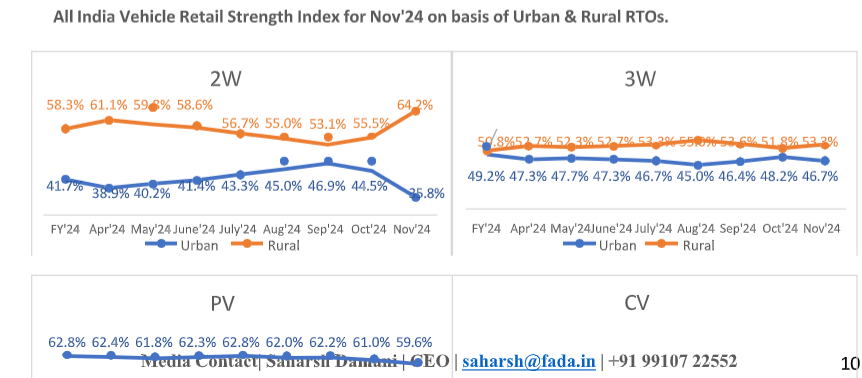

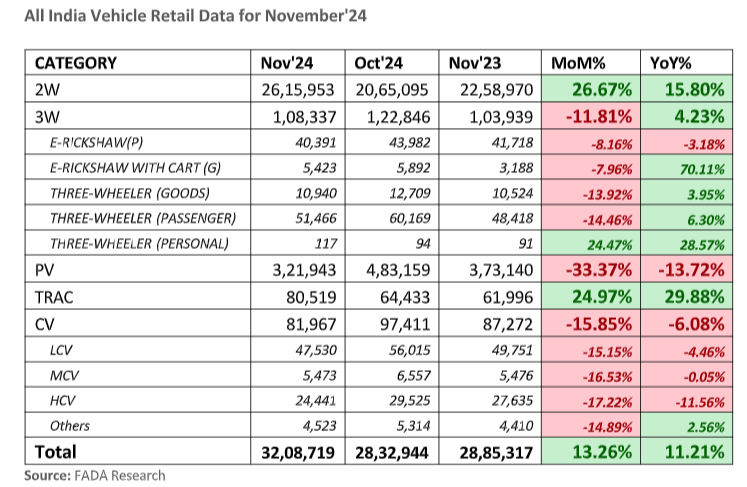

Two-Wheelers (2W), Three-Wheelers (3W), and Tractors (Trac) posted Year-over-Year (YoY) growth of 15.8%, 4.23%, and 29.88%, respectively. In contrast, Passenger Vehicles (PV) and Commercial Vehicles (CV) reported YoY declines of 13.72% and 6.08%. Month-over-Month (MoM) comparisons mirrored these uneven results, with 2W sales growing by an impressive 26.67%, while PV and CV segments contracted sharply by 33.37% and 15.85%, respectively.

FADA President, Mr. C. S. Vigneshwar, noted that November’s performance was influenced by various factors. “While November was expected to build on prior momentum, particularly due to the marriage season, dealer feedback indicates underperformance overall. Rural markets provided limited support, primarily for two-wheelers, but marriage-related sales fell short of expectations. The late occurrence of Deepawali in October also caused a spillover of festive registrations into November, which influenced the month’s trajectory.”

Despite these challenges, the 2W segment set an all-time November record, even surpassing November 2023 levels. Festive spillover significantly boosted sales, although the marriage season failed to deliver the anticipated momentum. Rural demand and year-end offers may continue to lend support to this segment, though no major surge is expected.

The PV segment faced several headwinds, including weak market sentiment, limited new launches, and the shift of festive demand into October. Dealers reported that rural demand, while present, was insufficient to lift overall sentiment. Inventory levels saw a minor correction, reducing by around 10 days, but remained high at 65–68 days. FADA continues to urge OEMs to rationalize supply to ensure healthier inventory levels as the industry heads into the new year.

For the CV segment, the challenges were more pronounced. Dealers highlighted restricted product choices, older model issues, limited financier support, and the absence of major festivals in November as significant hurdles. External factors such as elections, subdued construction activity, and weak coal and cement industries further dampened sentiment. Buyers also delayed purchases in anticipation of newer model-year vehicles. However, selective OEM schemes and year-end offers may provide some lift to the segment, offering hope for stability in the short term.

Looking ahead, FADA shared a cautiously optimistic outlook for December. The anticipated bumper Kharif harvest is expected to temper food inflation, which could improve consumer sentiment across segments. For two-wheelers, stable rural demand and potential year-end discounts could provide mild support. In the PV segment, heavy discounting and improved product availability are expected to mitigate weak consumer sentiment and the usual year-end lull. Aggressive promotions and end-of-year schemes may attract buyers, although some customers may defer purchases until new-year models are available.

The CV segment continues to face a challenging environment. Sluggish infrastructure activity, subdued industrial demand, and cautious buyer behavior remain hurdles. However, targeted incentives, year-end schemes, and stable financing conditions could help prevent a sharper decline.

In summary, while December’s prospects are mixed, they lean toward stability, with pockets of potential growth. The broader mood remains cautiously optimistic, supported by rural stability, easing inflation, and selective year-end promotions.

Key Findings from our Online Members Survey

- Liquidity

- Neutral 53.72%

- Bad 31.08%

- Good 15.20%

Sentiment

- Neutral 49.66%

- Bad 33.11%

- Good 17.23%

Mega Marriage Season in November’24

- Flat 66.89%

- De-Growth 23.99%

- Growth 09.12%

Whether booking pipeline for Dec’24 was getting traction?

- No 69.00%

- Yes 31.00%

Expectation from December’24

- Flat 40.54%

- Growth 39.19%

- De-growth 20.27%