South Asia bucks the trends with India-driven growth

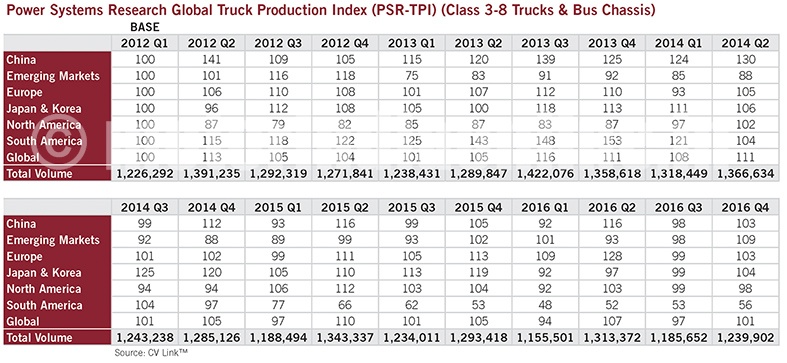

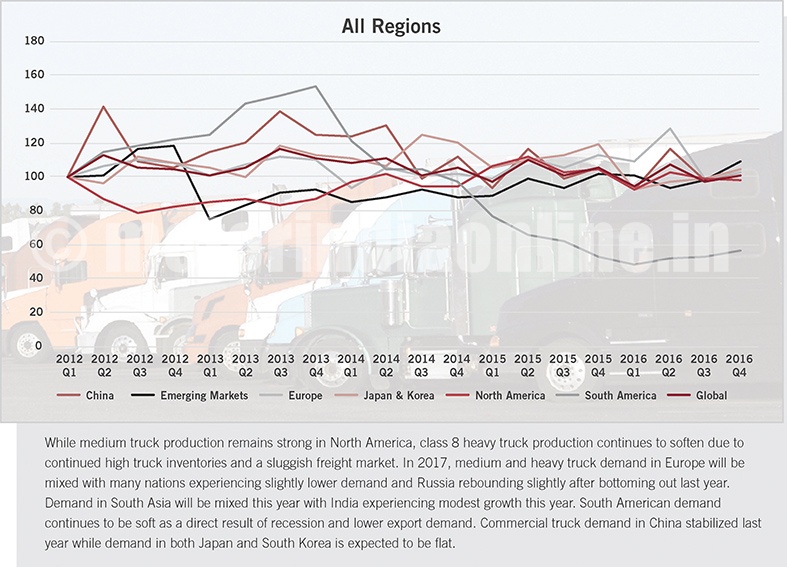

The Power Systems Research Truck Production Index (PSR-TPI) dropped four points, from 105 to 101, or 3.8 per cent, for the twelve-month period ended December 31, 2016. The TPI dropped sharply in Q1 2016 to 94 but then rebounded strongly in the second quarter. The TPI posted a strong gain in Q4 2016, climbing 4.1 per cent, from a weak 97 in Q3 2016 to finish at 101 in Q4 2016.

Total global truck production dropped from 1,293,418 in Q4 2015, to 1,239,902 in Q4 2016, a decline of 53,516 units or 4.1 per cent, for the year.

The PSR-TPI measures truck production globally and across six regions: North America, China, Europe, South America, Japan & Korea and Emerging Markets. This data comes from CV Link, the proprietary database produced by Power Systems Research.

Europe: The biggest drop was in Europe. The Europe TPI dropped from 113 in Q4 2015 to 103 in Q4 2016, a decline of 10 points, or 8.8 per cent. The Index jumped to 128 in Q2 2016 but then fell to 99 in Q3 2016, before rebounding to 103 in the fourth quarter last year. In 2017, medium and heavy truck demand in Europe will be mixed, with many nations experiencing slightly lower demand.

In part, low commodity prices continue to depress various regional economies including South America, South Asia and Eastern Europe, which are significant exporters of oil and other commodities.

North America: While medium truck production remains strong in North America, class 8 heavy truck production continues to soften due to continued high truck inventories and a sluggish freight market. Medium and heavy truck production is expected to decline by 3 per cent this year, compared to 2016.

Class 8 truck production is expected to continue its decline by falling 8 per cent, while the medium (class 4 – 7) segment should improve by 2.2 per cent, compared with 2016. In the class 8 segment, higher truck inventories, lower freight demand and lower prices for used class 8 trucks have put significant pressure on new truck demand. Construction spending continues to support demand for medium duty and vocational trucks.

Russia: Russian production will rebound somewhat after bottoming out last year. Demand for medium and heavy trucks is expected to decline slightly this year after experiencing modest growth in 2016. After a few years of very poor demand, Russian production is expected to improve by 6.7 per cent this year. While demand is still relatively low, it appears to have bottomed out.

United Kingdom: So far, the United Kingdom has not experienced any significant negative ramifications since the UK announced its exit from the European Union.

Turkey: In Turkey, a poor economy and the additional cost of the Euro VI emission technology resulted in a decline of more than 50 per cent in production of medium and heavy trucks in 2016.

South America: South American demand continues to be soft as a direct result of recession and lower export demand. The South American TPI has stumbled from a high of 148 in Q3 2013, and has dropped steadily to a TPI of 56 in Q4 2016, a decline of 92 points, or 62.1 per cent. In Q4 2015, the South American TPI was 53, but it remained relatively flat through the year.

Demand for medium and heavy trucks continued a sharp decline throughout 2016 with 2017 expected to remain soft as the nations of South America battle through a very strong recession. Overall, South American medium and heavy truck production is expected to finish the year up 7.8 per cent over a very weak 2016. Production in Brazil is expected to increase by 8.3 per cent this year while Argentinean production is forecasted to increase by 2.1 per cent. Venezuelan production will continue to be non-existent with no improvement in sight.

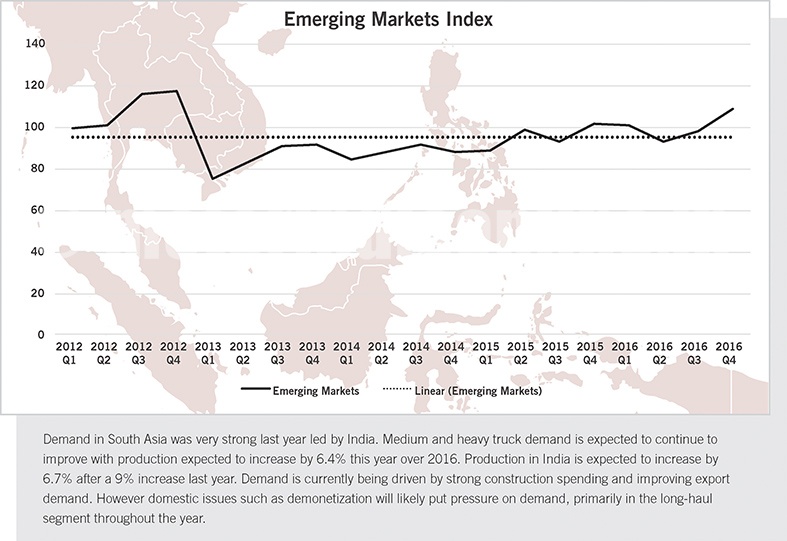

South East Asia: Demand in South Asia was very strong last year led by India. However, Demand in South Asia will be mixed this year, with India experiencing modest growth over the year. Medium and heavy truck demand is expected to continue to improve with production expected to increase by 6.4 per cent this year over 2016. Production in India is expected to increase by 6.7 per cent after a 9 per cent increase last year. Demand is currently being driven by strong construction spending and improving export demand. However domestic issues such as demonetization will likely put pressure on demand, primarily in the long-haul segment throughout the year.

Commercial truck demand in China stabilized last year while demand in both Japan and South Korea is expected to be flat. After a relatively strong year in 2016, medium and heavy truck demand in China is expected to remain solid this year. China’s economy is still struggling with significant overcapacity in both the real estate and manufacturing segments. As expected, only truck replacement demand is needed.

By Jim Downey, Vice President – Global Data Products, Power Systems Research, and Chris Fisher, Senior Commercial Vehicle Analyst, Power Systems Research