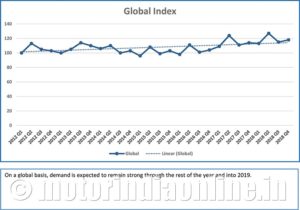

The Power Systems Research Truck Production Index (PSR-TPI) increased from 113 to 127, or 12.4%, for the three-month period ended June 30, 2018, from Q1 2018. The year-over-year (Q2 2017 to Q2 2018) gain for PSR-TPI was 124 to 127, or 2.4%.

The PSR-TPI measures truck production globally and across six regions: North America, China, Europe, South America, Japan & Korea and emerging markets.

This data comes from CV Link, the proprietary database maintained by Power Systems Research.

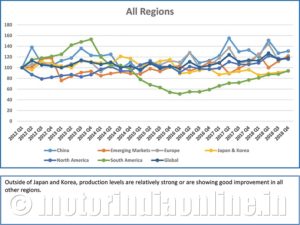

Global Index: On a global basis, commercial vehicle demand is expected to remain strong through the rest of the year and into 2019. Outside of Japan and Korea, production levels are relatively strong or are showing good improvement in all other regions.

North America: In 2018, medium and heavy commercial truck production is expected to increase by 14.7% over last year, driven by extremely strong class 8 demand along with continued strength in the medium duty (class 4-7) segment. Production levels for class 8 trucks are expected to increase by 26.6% this year, while medium truck production is projected to remain strong and increase by 1.3% over 2017.

Europe: Medium and heavy truck production is expected to increase by 5.4% in Greater Europe this year over 2017. Production in Western Europe should increase by 2.6%, while production in Eastern Europe could increase by 15.2% as the fleets continue to replace their aging trucks. After weak demand in Eastern Europe over the past few years a recovery in demand is in full swing. Demand in Western Europe continues to be relatively strong this year.

South Asia: Medium and heavy commercial truck demand in South Asia is expected to improve this year over 2017. Production for medium and heavy trucks should increase by 15.1%, led by stronger demand in India. Production in India is expected to increase by 20% this year after a soft 2017 primarily due to the implementation of the BS-IV emission regulations which increased the cost of trucks. Additional infrastructure spending is expected to boost demand in India during the next few years.

South Asia: Medium and heavy commercial truck demand in South Asia is expected to improve this year over 2017. Production for medium and heavy trucks should increase by 15.1%, led by stronger demand in India. Production in India is expected to increase by 20% this year after a soft 2017 primarily due to the implementation of the BS-IV emission regulations which increased the cost of trucks. Additional infrastructure spending is expected to boost demand in India during the next few years.

South America: After several years with very low medium and heavy truck demand, domestic and export sales started to improve last year and production in South America is expected to increase by 20% in 2018, driven by Brazil. While truck exports are a main reason for this increase, domestic demand has also significantly improved during the past year. Production in Venezuela has stopped.

Japan/Korea: Medium and heavy truck demand is expected to continue its decline by falling 7.4% this year as softness in domestic demand continues to impede the manufacturers. Japanese production should decline by 7.5%, while production in South Korea should fall by 5.3% compared with last year. Production continues to be transferred from Japan and Korea closer to their traditional export markets.

Greater China: Through the first four months of 2018, relatively strong medium and heavy truck demand continued in China and is expected to remain at replacement levels through the rest of the year. Medium and heavy truck production is expected to decline by 8.3% this year, while heavy truck production is projected to decline by 11% compared to 2017. With the introduction of the GB1589 regulations to control overloading of trucks last year, commercial truck demand was very strong in 2017.

By Chris Fisher, Senior Commercial Vehicle Analyst, Power Systems Research, and Jim Downey, Vice President – Global Data Products, Power Systems Research