A report by Chris Fisher, Senior Commercial Vehicle Analyst at Power Systems Research and Jim Downey, Vice President (Global Data Products) at Power Systems Research provides a forecast for medium and heavy commercial vehicles around the world

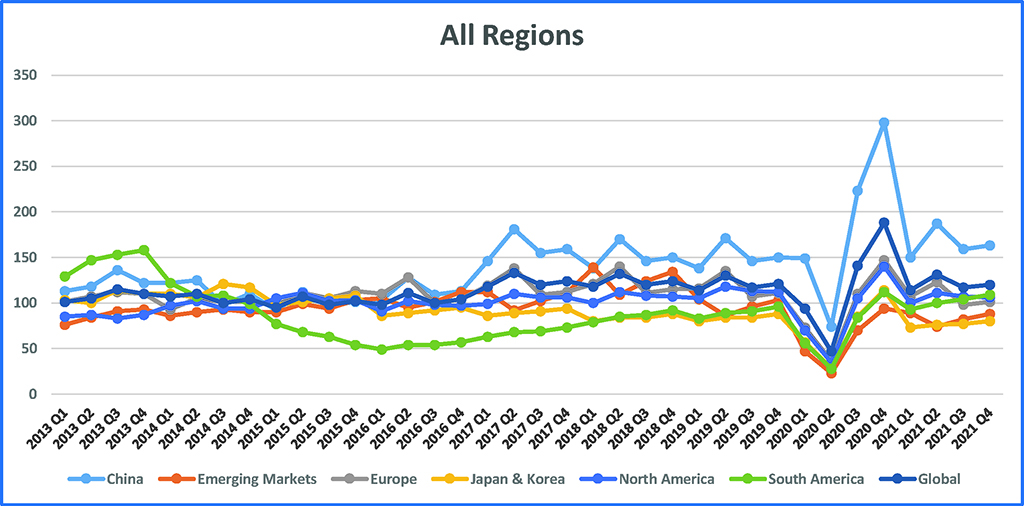

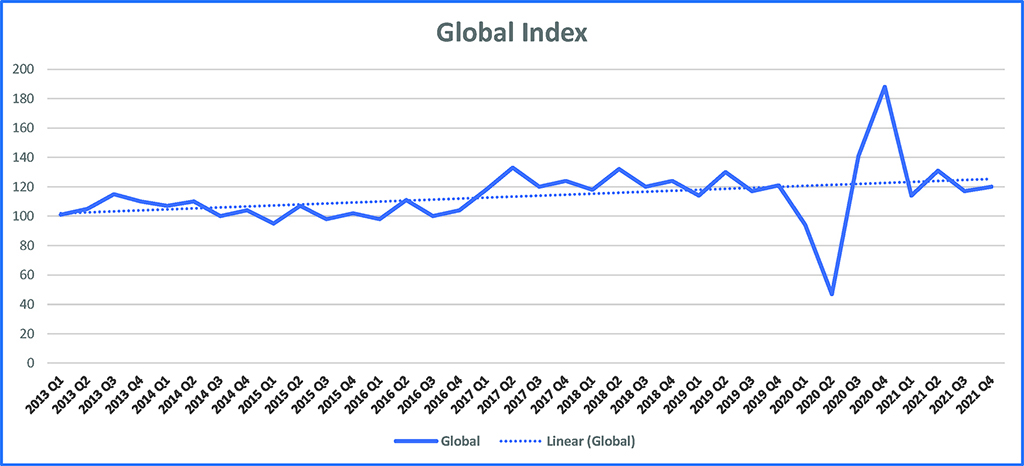

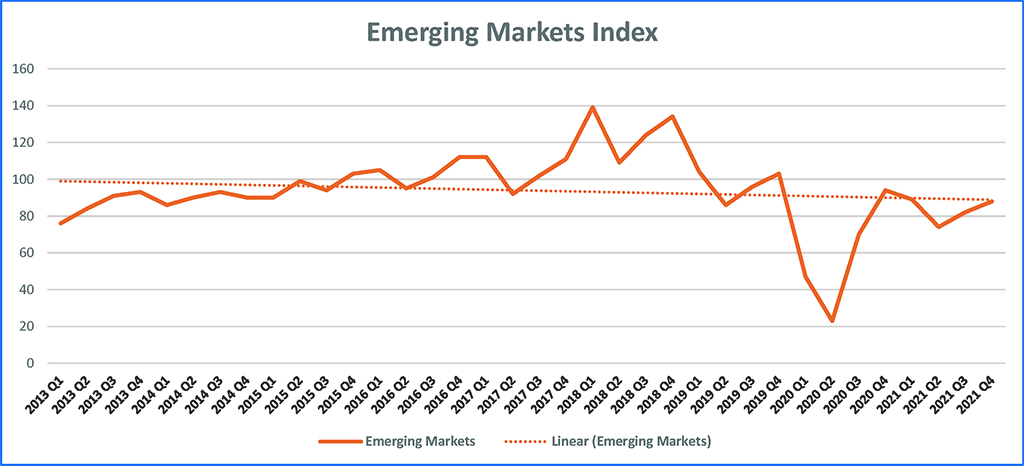

The Power Systems Research Truck Production Index (PSR-TPI) dropped from 131 to 117, or 10.7%, for the three-month period ended September, 30, 2021, from Q2 2021. The year-over-year (Q3 2020 to Q3 2021) loss for the PSR-TPI was 141 to 117, or 17%. Except for China, all regions are expected to experience solid commercial vehicle demand growth this year and into 2022. Chinese heavy truck demand is expected to decline this year primarily due to the implementation of the China VI emission regulations that adds cost to the vehicles but no significant improvement in fuel economy.

The PSR-TPI measures truck production globally and across six regions: North America, China, Europe, South America, Japan and Korea and the Emerging Markets. This data comes from OE Link™, the proprietary database maintained by Power Systems Research. The following are the conclusions drawn from the study:

1. Global Index: Overall, medium, and heavy truck demand will finish the year on a strong note and continued strength is expected into 2022. Ongoing supply chain disruptions will continue to impact production throughout the rest of the year and well into 2022.

2. North America: While freight demand continues to be strong particularly in the consumer segment, the continued worker shortage along with ongoing supply chain disruptions is hurting vehicle production across all segments. The production disruptions are expected to continue well into 2022. While the overall economy is expected to remain strong through next year, rising inflation will continue to be a concern moving forward.

3. Europe: During the first six months of the year, European medium and heavy commercial truck registrations improved by 33.1% compared to the same period in 2020. While truck order bookings remain strong, Europe is facing the same problems as other regions with various supply chain disruptions. Most OEMs have been forced to scale back production due to a lack of components, most notably, semi-conductor chips.

4. Greater China: Heavy truck demand during the first half of the year was strong primarily due to a truck pre-buy ahead of the China VI emission standard implementation in July 2021. The costs of the emission technology for China VI vehicles are not offset with any significant improvement in fuel economy. Medium and heavy commercial vehicle production is expected to decline by 21% this year over 2020 before bottoming out in 2022.

5. South Asia: Medium and heavy commercial vehicle production in India is expected to reach 2,65,000 vehicles in 2021 which is an increase of 63% over last year. Slight demand growth in India is expected in 2022 and 2023 before declining in 2024 partially due to it being an election year. In India, the focus is moving toward more infrastructure-related spending which is good for the vocational market. However, increasing use of rail freight, worker shortages and increasing commodity prices will likely slow truck demand during the next few years.

6. Japan and Korea: Medium and heavy commercial vehicle production in Japan and South Korea is expected to increase by 18% this year over 2020. South Korean production is expected to increase by 24% this year and Japanese production is forecasted to improve by 17%. Earlier in the year, Japan was hit particularly hard by supply chain disruptions.

7. South America: Medium and heavy commercial vehicle production is expected to increase by 48.8% this year over 2020 with truck production improving by 57.5%. Increased vaccinations and an overall improving regional and global economy are driving the growth in vehicle demand. However, continued supply chain disruptions are negatively impacting production and this trend is expected to continue throughout the remainder of the year.

About PSR

Power Systems Research has been tracking the production of engines and their use around the world for 45 years. It is one of the leading companies in the world doing this research and building these databases. It has many of the largest companies in the world as its customers, including John Deere and Caterpillar who subscribe to its unique database and their facilities around the world access PSR’s data and forecasts through the internet round-the-clock. PSR is based in St. Paul, Minnesota, and has offices and analysts located around the world, from Brussels to Beijing and Tokyo to Brazil, to help collect and analyse this data. The next update of the Power Systems Research TPI will be in January 2022 and will reflect changes in the TPI during Q4 2021.