Company eyeing Rs. 1,000-Cr revenue by 2027

The Rane Group, a stalwart in the Indian automotive components industry, has carved a formidable presence in both the domestic and international markets. Known for its unwavering commitment to quality and innovation, Rane has strategically positioned itself to capitalize on the evolving dynamics of the automotive aftermarket. As the sector undergoes significant transformation, driven by technological advancements, changing consumer preferences, and regulatory changes, Rane’s aftermarket business stands at a pivotal juncture. With an impressive revenue milestone of over Rs. 600 crores and a growing network, that spans the length and breadth of India, Rane’s aftermarket operations contribute significantly to the Group’s overall turnover. This exclusive article by N. Balasubramanian and Raghul Sivaguru delves into the strategic priorities, market dynamics, and future outlook of Rane’s aftermarket business. Through insights from a detailed interaction with T. Giriprasad, President – Aftermarket Business, Rane Group, we explore the factors shaping the automotive aftermarket landscape, the company’s robust distributor and mechanic networks, and the innovative initiatives driving growth and market penetration. Join us as we navigate Rane’s journey towards further consolidating its leadership in the aftermarket sector, amidst a rapidly changing automotive ecosystem.

How big is Rane Group’s aftermarket business? Which companies within the group have an active presence in the aftermarket, and what is the share of each to your overall business?

The aftermarket business of Rane is about 9% of the total turnover of the Group as of 2023-24. Recently, we crossed a significant milestone of Rs. 600 crores in aftermarket business revenue. Except for companies like Rane NSK Steering Systems Ltd and the light metal casting division of the group, the rest of the five group companies/divisions, namely Rane Madras Ltd, Rane Engine Valve Ltd, Rane Brake Lining Ltd, ZF Rane Automotive India (SGD), and Rane Auto Parts, are present in the aftermarket. Steering components and friction material parts account for nearly 70% of the aftermarket revenue. Some of the companies have been in the market for more than four decades, and the Rane brand has become a household name in most markets across India.

It is indeed a matter of great pride for all of us at Rane that the brand has such popularity and visibility from Kanyakumari in the south to Kashmir in the north. We are very grateful to our customers for showing this support and loyalty to our brand.

There is much talk about the automotive aftermarket in India undergoing a major transformation. Helming the aftermarket arm of one of the largest and most respected auto component brands in the country, what do you consider are the major factors shaping/contributing to this transformation, both positively and challengingly? You can pick the top three factors and elaborate.

The automotive aftermarket has been evolving over the last two to three decades and has become a big focus area for all auto component manufacturers as well as OEMs.

In the mid and late ‘90s, it was a kind of sellers’ market when it came to servicing the spare requirements in the marketplace. Based on the availability of capacities and fulfilling other contractual obligations with OEMs and export customers, supplying to the independent aftermarket was the last priority.

However, post-2000, companies started realizing and recognizing the importance of revenue from this business segment. Not only was profitability gaining importance, but it was also a strategic de-risking approach for several auto component companies to have substantial revenue from the aftermarket segment as part of their overall turnover. Hence, we started seeing more genuine component manufacturers focusing on this segment with a moral obligation to make genuine parts available for service to end customers.

In the last decade, one important transformation for component manufacturing companies is that exclusive lines and capacities were being allocated for servicing the aftermarket customers. This was a huge shift from the earlier practice of supplying parts to the market based on the available balance after servicing OEM customers.

In the current decade, there is a big race among established and unorganized component manufacturing companies to get a decent share of this lucrative business. This has led to many competitiveness issues and also the proliferation of non-genuine parts flooding the market, posing a huge threat to some safety-related vehicle parts. While the implementation of GST has reduced several unhealthy practices, it is still a concern that this has not significantly shifted the landscape to more genuine parts availability. The attractiveness of this market has also propelled many component manufacturers to explore growth avenues not only through organic revenue generation opportunities, due to the increasing vehicle population every year but also to focus on inorganic growth revenues. This means companies are ready to work with several MSMEs to develop products specifically for the aftermarket, even if they do not supply to OEMs. The approach also stems from the noble thought process of ensuring that customers have options to choose from genuine competitive brands rather than looking at unorganized and/or spurious parts widely prevalent in the market.

What is Rane Group’s strategy/priority focus areas for growing the aftermarket business? How are these aligned with the dynamics of the overall auto aftermarket landscape?

For the past 10 years, Rane Group has significantly increased its focus on servicing the aftermarket. This business segment’s growth is entirely dependent on “grass-root level” works with end mechanics and retailers to generate demand. Hence, the priority focus for us has been to have a strong field team that ensures continuous customer connection and relationship building. Unlike previous years, the team is now provided with the necessary training on key aspects like negotiation skills, time management, data analytics competency, and relationship management, so they are well-equipped to face customers with the needed skills and confidence.

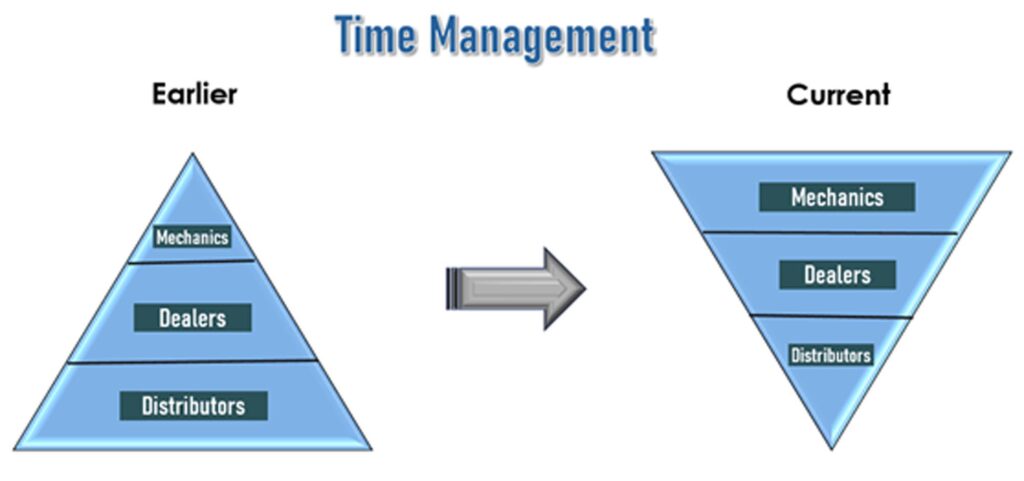

The team has changed its approach towards the allocation of time with various customer interfaces to ensure growth in demand generation. Earlier, the team’s focus was on time allocation as per the diagram shown below. However, for more effective results, we now have an inverted triangle regarding the field team’s time spent with various customer levels

This has helped us strengthen our brand recall with mechanics and retailers, who are the principal consumers of the parts and important decision-makers on which brand to buy and service their customer base.

As for our business growth strategy, we continuously evaluate ourselves on the following key aspects:

What are the ‘growth buckets’ to look at? (Organic growth, market share, product range, inorganic growth opportunities, etc.)

What should we do to capitalize on these available growth opportunities?

Where should we compete? (Geography/markets, product segments, value chain – forward or backward integration, etc.)

How should we compete? (Product mix, availability & inventory, cost management, scale of business, etc.)

How strong is your network of distributors and retailers across the country? What do you look for when you appoint a distributor for a particular product line/region?

The entire backbone of our aftermarket business is the strong channel we have, right from making the parts available through our distribution partners’ branches (around 1,000) spread across the country, to the vast retailer and mechanic base we have built over the years. As of last month, we have about 10 strong national and regional distribution partners with coverage of more than 15,000 retailers. Currently, we have a mechanic base touching close to 40,000. The expansion of the channel network is driven by continuously identifying unrepresented and weak markets where Rane’s products have opportunities for expanding reach and enhancing revenues. Our strategy for expanding distribution is purely driven by the capabilities, reach, and hunger for business of our existing partners.

How good is your connection with mechanics, who play an important role in the aftermarket ecosystem? What initiatives have you undertaken to strengthen your connection with mechanics and boost your brand in the market?

As mentioned earlier, our field team spends maximum time with mechanics and garages during their daily market visits. This connection helps us get quick feedback on our product quality and services, such as availability and additional needs to help mechanics delight their customers (vehicle owners). Apart from these requirements, mechanics’ expectations, such as quick settlement of their fitment incentives and prompt resolution of quality issues, are being effectively met to ensure their loyalty to the Rane brand.

At the beginning of every financial year, we identify focus markets where we want to strengthen our mechanic connection. We conduct joint Rane Group mechanic meets in these markets, where we exhibit our current and new product lines available in our portfolio. This forum helps us maximize our connection with key influencers in those markets and showcase our entire Rane Group strength. We also conduct mega dealer meets in identified hotspot markets, with the same objectives of improving our market connection and exhibiting our diverse product portfolio under one umbrella.

As digitization and digitalization rapidly pick up in the aftermarket, Rane utilizes this mode for brand promotion. We have a common Rane Group Aftermarket App that demonstrates our available products with convenient navigation. We constantly engage our customers through digital media like LinkedIn, Face book, Twitter, etc. We have also digitized our entire mechanic base into our SAP system, which helps our current field force and new entrants understand the mechanics they need to focus on. Additionally, we have created a WhatsApp account for the entire mechanic base to push information on key events, such as new product launches and participation in important exhibitions/shows, to the entire ecosystem of mechanics and retailers.

Your thoughts on the elimination of ‘redundant’ layers in the aftermarket value chain – is there scope for this to happen? Also, what is the influence of online retailers in this regard?

The ‘traditional’ distribution model has successfully operated over the past couple of decades, expanding the aftermarket business for component manufacturing companies like Rane. The key aspect of ‘product availability’ was addressed by this model through the expansion of distributors’ branches across India, making products available to retailers and mechanics nationwide. With competition increasing daily, there is an expectation of enhanced efficiency and effectiveness in this distribution model. It has become imperative for them to ‘reinvent’ themselves to remain relevant in this competitive environment.

The ‘redundancy’ of any network layer would entirely depend on how convincingly they bring ‘value’ to their principals’ product lines. If this is ensured, the existing model would continue successfully. However, I do not rule out chances of restructuring and consolidation happening in this distribution model in the near future based on necessity. We are also seeing restructuring in how garages organize themselves now.

There is some movement in the ‘online’ space in the auto-component business. While some aesthetic and non-technical parts have started picking up through this channel, there has been no major shift towards technical parts’ servicing through the online channel. Even in established markets in developed countries, we hear that online channel penetration is only around 6 to 8%, despite a head start to this business model. However, Rane will not lose visibility on such developments and will adapt to market dynamics.

Vehicle OEMs seem to have sharpened their focus on OE spares, having understood that there is plenty of untapped potential in the space. What are your thoughts on how this has impacted the independent aftermarket, not just from Rane’s point of view, but also from a distributor and retailer point of view?

Yes, the focus of OEMs on the spares market has significantly increased in the past eight to ten years. They see this as an important component of their revenue stream. While the competitiveness of OE spares with established and organized independent aftermarket players has increased, OEMs have been catalysts for providing opportunities to component makers for pursuing this revenue stream.

It is also a fact that the price advantage of OE spares compared to independent aftermarket players has tilted the balance towards OEMs, allowing them to better capitalize on this opportunity over the last few years. However, it is up to organized component manufacturers to focus on their strengths, leverage the aftermarket, and work on controllable aspects rather than get disheartened by issues beyond their control.

How strong is Rane in the aftermarket in overseas markets? What share of your business comes from exports, and which are the major markets/regions? Any new focus areas/regions on your radar for further growth and expansion?

The exports component of the aftermarket for the Rane group is still in a nascent stage. We do only about Rs. 100 crores in aftermarket spares exports, catering to countries and regions like the Middle East, SAARC countries (Sri Lanka, Bangladesh, Nepal), the UK, European Union countries (Germany, Belgium, Spain), and the US. We have started in a small way in countries like Australia, Brazil, China, and some East African customers. Friction products and engine components like valves form the major portion of this aftermarket export business. We will continue to identify opportunities for our various product lines globally, as this provides a huge potential for growth. The major challenge in pursuing this business segment would be investing in tooling for various models, for which demand varies from two-digit numbers to several thousand. We will continue evaluating the important balance between revenue generation and investment while pursuing this business opportunity.

What does the future of Rane’s aftermarket business look like over the medium to long term? What do you see as the major growth drivers and what are your targets for the coming years?

A few years back, our group aftermarket business formed close to 12 to 13% of our overall group sales revenue. Although we continued our aggressive growth in the aftermarket business in the last few years, due to substantial growth in OEM and OE exports business, the aftermarket business now forms only 9% of our overall group sales. The mandate from our chairman to the aftermarket team is to quickly hit the next milestone of M1K (Rs. 1,000 crores revenue) by 2027 and increase aftermarket segment to at least 12 to 13% of the total Rane Group sales revenue.

The major growth drivers would be:

Organic growth based on the increasing vehicle population

Increasing the product range in each vehicle segment we currently service

Inorganic growth through specific identified product development and launches

Improving our market share through enhanced market penetration and offering compelling and excellent services to our end customers