Targets Rs. 4,000 crore revenue by 2023

As a distinguished supplier of forged and rolled components for the automotive industry in domestic and global markets, Ramkrishna Forgings Ltd. (RKFL) aims for the stars by benchmarking itself as a reliable supplier of critical items for automotive industry in the years to come. Starting its journey in 1981 as a manufacturer of forged components for railways, the Kolkata-headquartered company forayed into the automotive space from the year 2000 onwards, especially in the commercial vehicle space. Years later, RKFL is now a flagship supplier of forged and ring-rolled products for the Front and Rear Axles, Engine and Transmission systems, among others, to all major commercial vehicle OEMs or Tier-I across the globe. Its clientele includes Volvo, Mack Trucks, DAF, Ford Trucks, IVECO, Daimler & soon the two prestigious OEM’s in Europe and Tier-I suppliers like Dana, Meritor-Sisamex & American Axles, along with some major domestic brands like Tata Motors, Ashok Leyland, VE Commercial (Eicher) and BharatBenz.

As a distinguished supplier of forged and rolled components for the automotive industry in domestic and global markets, Ramkrishna Forgings Ltd. (RKFL) aims for the stars by benchmarking itself as a reliable supplier of critical items for automotive industry in the years to come. Starting its journey in 1981 as a manufacturer of forged components for railways, the Kolkata-headquartered company forayed into the automotive space from the year 2000 onwards, especially in the commercial vehicle space. Years later, RKFL is now a flagship supplier of forged and ring-rolled products for the Front and Rear Axles, Engine and Transmission systems, among others, to all major commercial vehicle OEMs or Tier-I across the globe. Its clientele includes Volvo, Mack Trucks, DAF, Ford Trucks, IVECO, Daimler & soon the two prestigious OEM’s in Europe and Tier-I suppliers like Dana, Meritor-Sisamex & American Axles, along with some major domestic brands like Tata Motors, Ashok Leyland, VE Commercial (Eicher) and BharatBenz.

At present, RKFL boasts five production facilities, four units located at Jamshedpur and an another one at Howrah, that extend an annual capacity of forgings close to 1,50,000 metric tonnes. It is spreading its wings in internationally, with dedicated offices and warehouses set up in the US and Mexico, Germany, Netherlands & Turkey and future plans to have machining presence out of India. Thanks to huge volumes, exports account for over 30 per cent of revenue with an endeavor to achieve Rs. 1,450 crores plus revenue this fiscal year. Its product portfolio is as diverse as its market presence, ranging from 2 kg to 250 kg in as Forged, Heat Treated & Machined condition, and Ring Rolling items in the weight range of 20-75 kg.

Without forged metals, the human civilization we belong to and the industrial culture we live in would surely crumble. Fascinatingly, forging techniques date back to over 6,000 years, with bronze and iron undergoing hot forging to make tools and jewellery in the early days. The advent of steam power in the 19th century prepped the industrial forge for the modern age, while the discovery of steel making revolutionized the industry to produce a great assortment of forged parts for weaponry, railways, cars and agricultural equipment.

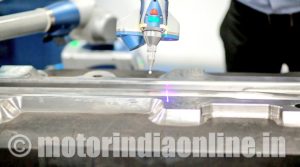

Technology has been a prime driver for this industry, with enhanced forging press techniques and equipment opening up new avenues across the time, including the assistance of computer systems in precision hammering these days. Today, forging contributes significantly to the development of various industries, automotive being one of them, by offering key components of any desired shape and size with high tensile strength and uniform composition and structure.

Forged components turned out to be a boon for the development of automotive and truck applications since beginning. Motor vehicles demand unique forged parts at various points of shock and stress, from load bearing axles to flyspeck transmission gears and bearings. Hence both the forging and automotive industries mutually nurtured each other in the last century to do wonders. Now, automotive being the prime growth driver, the global steel forging market for vehicle applications is expected to reach $56 billion in 2022, with a CAGR of 5.1 per cent in 2017 and 2022 as per estimates.

Changing market dynamics

In India, the forging industry supports the automotive sector in a big way, accounting over 70 per cent of its production and has contributed tremendously to the local economy by way of employment to lakhs of people and exports to international markets. With over 45 years of work experience in forging business, Mr. Mahabir Prasad Jalan, founding Chairman and mentor of RKFL, says that the local industry’s journey wasn’t a cakewalk since industrialization in 1950s. “Lack of modernized techniques and lower volumes leading to unfair price plagued the forging industry for so long. But with improved capital expansion and capacity utilization, Indian players are surging ahead in a big way lately, complemented by increasing global demands for forged products. In a matter of a few years, the Indian forging industry is going to transform into a global story” he assures.

Although the industry is a bigwig supplier of essential auto parts, it is unique and is a different ball game altogether. “Forging isn’t a business that is run from air-conditioned chambers”, notes Mr. Naresh Jalan, Managing Director, RKFL. “It is both labour and capital intensive, and the validation and lead-time for products are higher than any other auto components”.

RKFL has just achieved ROE (return of equity) of 18 per cent, after almost 37 years of existence in forging, he adds.

Is there a dearth of business or lack of pricing? Mr. Jalan says a firm ‘no’, and adds that “there exists a huge volume in the automotive sector globally, and one needs to find the right market”.

He explains that with booming demand for automobiles, the sector is fast expanding. Especially in the CV segment, for instance, long-haulage multi-axle trucks are becoming the new norm, resulting in trebling the previous demand for key components. But suppliers of auto ancillaries are facing huge challenges in scaling up their capacities, as players grown organically out of adequate and timely capex are very few…. they were not given due credit in terms of growth patronage and investments in spite of having growth prospects almost double that of OEMs.

RKFL feels that time has come when the structural shrinkage of supplier capacity is actually empowering the component industry in terms of pricing and capital expansion. “Lack of quality and able suppliers in the market help companies with timely capacity building strategies to choose their price in the market”, says Mr. Jalan, as one OEM can be easily switched for others. Suppliers now find more options for their businesses and manufacturing margins are greatly improving, he adds. The Indian component industry is leveraging this situation in a big way, he observes, with robust growth and consolidation is likely to happen in both domestic and export businesses, with the latter expected to account for over 26 per cent by 2021.

Technology-driven approach

Where does RKFL stand in the afore-described development? The company’s team is betting dollars to donuts that demand for quality and affordable products in the coming years will put RKFL in a commanding position. “RKFL strives for good products at competitive prices, making us quite reliable in our spectrum of operations among global OEMs”, claims Mr. Milesh Gandhi, Vice-President (Marketing and Sales).

Asked about modus operandi, he cites investment in technology and continual improvements in systems as the core values of his company. “Our products are competitive because of our higher yields out of superior technologies in manufacturing, while we constantly offer lightweight design and quality improvement ideas to our clients to decide”.

The RKFL team seems to be guided by a titanic long-term vision for quite some time now. The company went for a massive capacity addition worth $110 million three years back, positioning it into a whole new league globally by pushing its capacity over 1,50,000 tonnes annually. That’s not all. An another capex is on the anvil in two years’ time – worth around $150 million in the form of two new production facilities – thrusting up its forging capacity to over 2,50,000 tonnes, with state-of-the-art wedge-type forging press technology. Mr. Gandhi was quick to point out that this constant technological endeavour as a USP of his company.

EVs – ‘It’s complicated’

The Managing Director, Mr. Jalan, also bets high hope on the new scrapping policy involving mandatory deregistration of 20 year-plus commercial vehicles, which is expected to come into effect by 2020. “This will kick-start a whole-new demand bubble for new generation vehicles in the country, much to the rejuvenation and comeback of the component industry in a big way”, he says.

What about the ubiquitous discourse of electric vehicles? Is electrification of automobiles disruptive, asked MOTORINDIA. “RKFL is explicitly doubtful and non-committal on EVs, thanks to the cost-effective nature of the domestic market and the sheer absence of supporting infrastructure, both in terms of manufacturing and end use. “There isn’t any convincing case for EVs to be disruptive to win over IC engines, not even in the distant future. Even in developed markets there is huge skepticism in the way technology and manufacturing is turning out”, replies Mr. Jalan.

On the other hand, he views the ongoing ‘EV wave’ as a bummer for the entire component industry. “There is a pronounced reluctance among investors on capital expansion of the ICE ecosystem and components, pinching out the already investment-starved auto ancillaries. The entire imagination of EVs is more of a stock market craze than any real transformation for the auto industry”, he observes.

But RKFL is quite determined. “While others are occupied in the EV fantasy, we will continue to focus on its core competence and periodic capital expansion plans already laid out. This strategy is going to be the game-changer for us in the near future”, Mr. Gandhi affirms.

Journey ahead

Asked about the current state of affairs of RKFL, it was revealed that almost 55 per cent of business revenue stems from the automotive sector, including exports in 2016-17. In the CV segment particularly, the domestic heavy duty truck maker trio – Tata Motors, Ashok Leyland, and VECV – alone accounts for over 40 per cent of the sales turnover (2017-18), toning up the company’s stature in the Indian trucking making industry. No wonder that RKFL has won accolades from all the three brands for being a proactive partner in their endeavor.

“Commercial vehicles are going to be our prime focus in future. Our ambition is to achieve a feat of at least one RKFL component powering every single truck plying on the globe”, says Mr. Naresh Jalan, while also maintaining that the passenger car segment is also meant for foraying. The construction equipment segment is a very stable market, he says, with a notable share of revenue that is seeing growth owing to jacked-up local manufacturing in India. For RKFL, the railway sector is now consolidating and awaits a huge capex with the opening of FDI, while other venture areas that seem bright are oil and exploration, power, and agricultural equipment.

At the international game, RKFL is stepping up its ante in the Far East market with the required quality and reliability standards, apart from the already existing businesses in Europe and Americas. “We work one hundred per cent for the satisfaction of our customers and partners, forge long-standing relationships that reflect the core values of RKFL”, claims Mr. Gandhi. “We exercise caution not to enter into someone else’s business turf, nor do we declare competition with others in our core territory. We have churned out our own core competence areas, in which we strive to be the best”, he adds.

“Honesty, dedication, and customer engagement are the three cardinal mantras that RKFL believes in. We strive to make value for all our associates, shareholders and customers. We strategize and approach business in these lines”.

– Mr. Mahabir Prasad Jalan, Chairman, RKFL

“We have a clear vision for the next five years. RKFL embarked on a significant capacity addition worth $110 million three years back. In two years from now, another capex worth of around $150 million is on the anvil, thereby pushing up our forging capacity to over 2,50,000 tonnes with state-of-the-art production technology. We strive to be a Rs. 4,000-crore revenue making company by 2023”.

– Mr. Naresh Jalan, Managing Director, RKFL