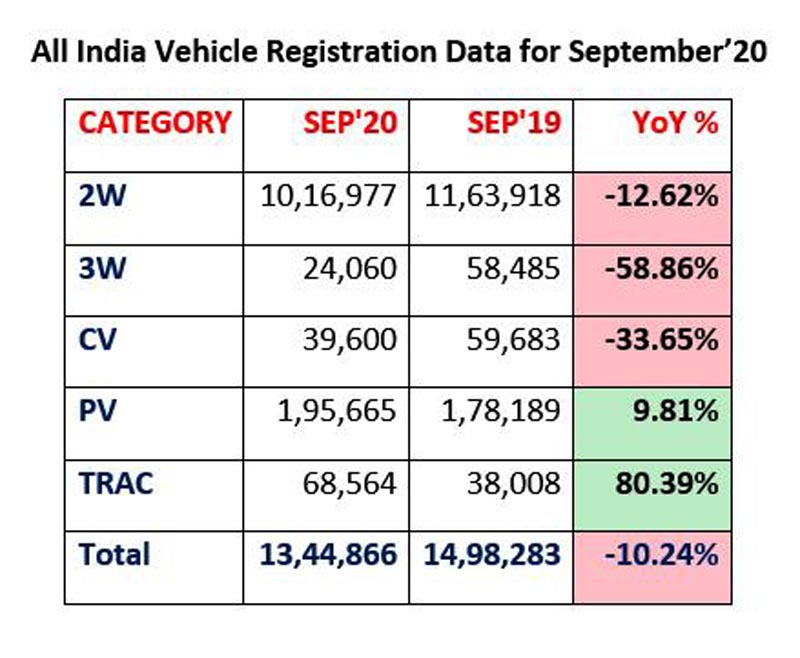

The monthly vehicle registration data for September’20 released by the Federation of Automobile Dealers Associations (FADA) shows promising signs of recovery in vehicle sales across all segments.

The vehicle registrations in September grew by 11.45% on a month-on-month (MoM) basis but fell by 10.24% on a year-on-year (YoY) basis.

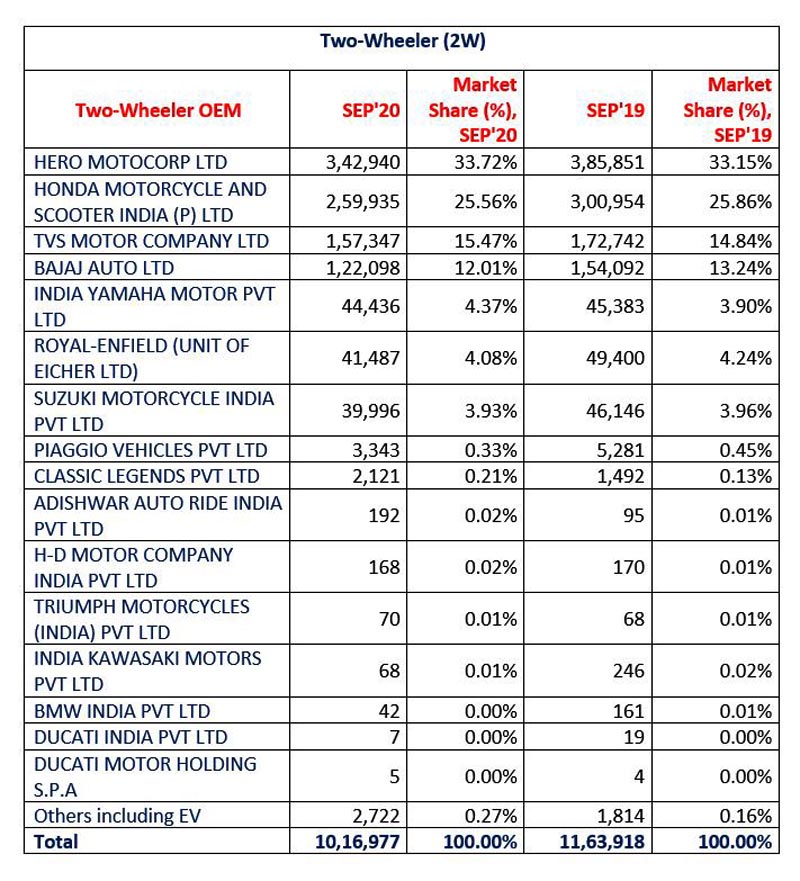

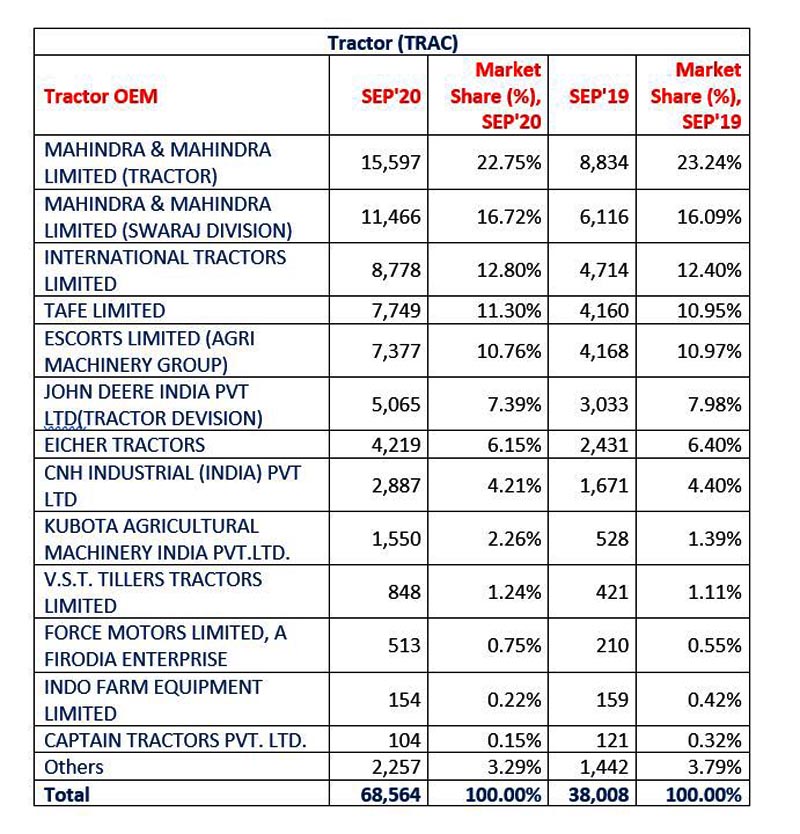

On yearly comparison, two-wheelers de-grew by 12.62%, three-wheelers by 58.86% and CVs by 33.65%. The passenger vehicle segment grew by 9.81%, the first upward movement post lockdown. Tractor registrations continued its upward journey with an astounding 80.39% YoY growth.

With social distancing the new normal, the government’s push to open urban areas and easing of vehicle financing, entry level passenger vehicles saw good demand.

Tractor sales in rural India continued its positive run as Kharif sowing witnessed record progress of area covered till date (1,116.88 lakh Ha. area sown compared to 1,066.06 lakh Ha. area).

Dealer inventory for both two-wheelers and passenger vehicles are at very high levels in anticipation of a good festive season. However, any further increase in inventory coupled with festival dampener will have a catastrophic impact on the health of auto dealerships.

Commenting on the sales during September’20, FADA President, Vinkesh Gulati said: “With the government’s persistent effort to unlock India, the month of September continued to witness automobile registrations on a rise as compared to previous months.

Passenger vehicles for the first time saw positive growth coming back on YoY basis. With social distancing on customer’s mind coupled with government’s push to further normalise business conditions and banks becoming more considerate to finance vehicles, entry level passenger vehicles saw good demand thus indicating a preference for personal transportation over public. New launches and vehicle availability played their part as catalysts. A lower base during last FY also helped the cause.

Tractor sales continued its dream run as Kharif sowing witnessed record progress of area covered till date when compared to last year. With good Rabi season resulting in good disposable income, rural market also saw its rub off effect on two-wheelers, small passenger vehicles and small commercial vehicles. Overall, two-wheeler, three-wheeler, and commercial vehicles continued to march ahead on MoM basis and inched up to narrow their gap with last year’s sale even though pre-COVID levels are yet to be seen across all categories.

While recently, the economic revival was mostly limited to rural India and impact of COVID-19 was still felt on larger States and urban centres, the top States which makes up half of India’s economic output (Maharashtra, Tamil Nadu, Uttar Pradesh, Karnataka, Gujarat and West Bengal) are now showing signs of revival as economic activities in these States are at its peak since lockdown began in March. This has also helped in creating a demand for automobile sales.”

Short-term Outlook

The months of October and November bring the much-awaited festival season of Navratri, Durga Puja and Diwali. With no more lockdown expected, as announced by the Central Government, FADA anticipates strong growth in automobile sales during these two months.

The government’s consideration to waive off interest on interest during moratorium up to Rs. 2 crores will help in improving customer sentiment thus making them conclude vehicle purchase decisions during the festive period.

With banks and NBFCs also gearing up with various festive offers to woo retail customers, auto sales is expected to witness a renewed growth and may close at par with last year, with passenger vehicles and two-wheelers anticipated to lead the way.

As a caveat, with the festival season round the corner and elections approaching in Bihar, the risk of COVID spread resurging may play spoilsport in specific regions. Inventory for two-wheelers stands at 45-50 days and passenger vehicles stands at 35-40 days. As indicated earlier, any dampener in vehicle sales during the upcoming festivals will have a catastrophic impact on dealers’ financial health.

FADA has once again advised extreme caution to both OEMs and dealers to avoid building any further inventory as this may lead to a disastrous situation similar to last two festive seasons when sales were below the mark.

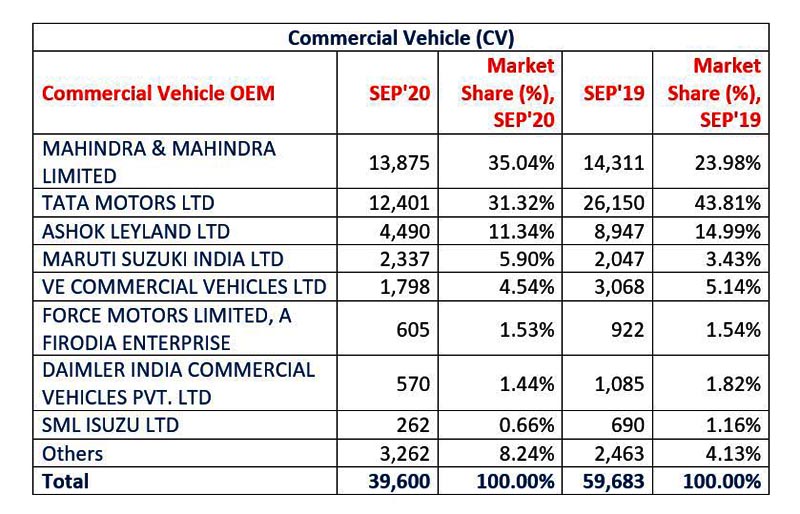

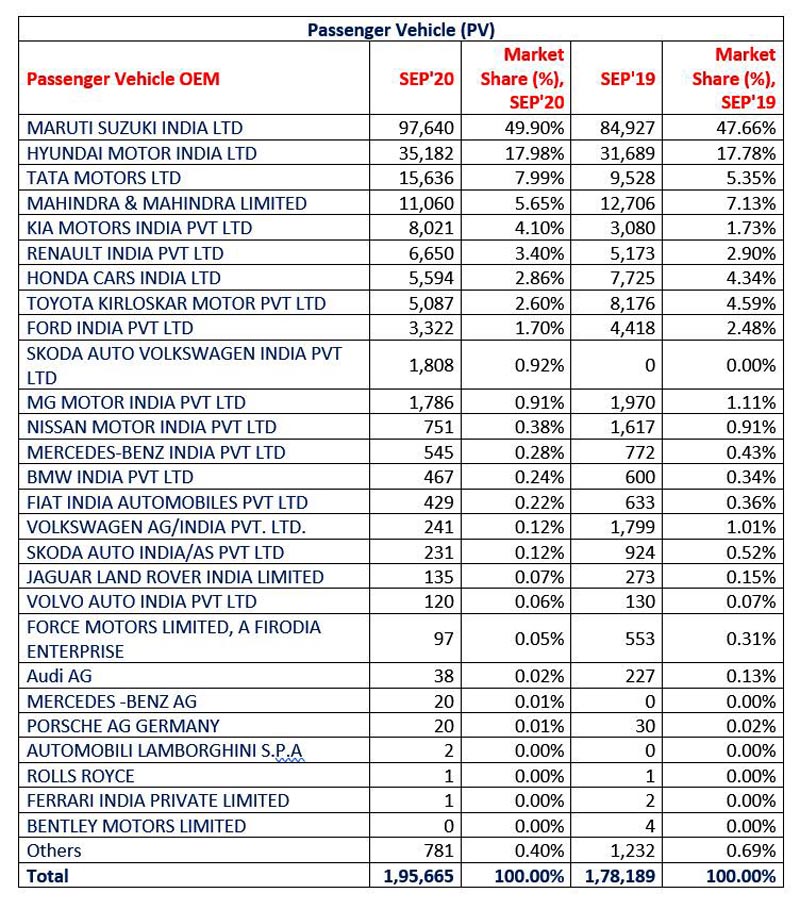

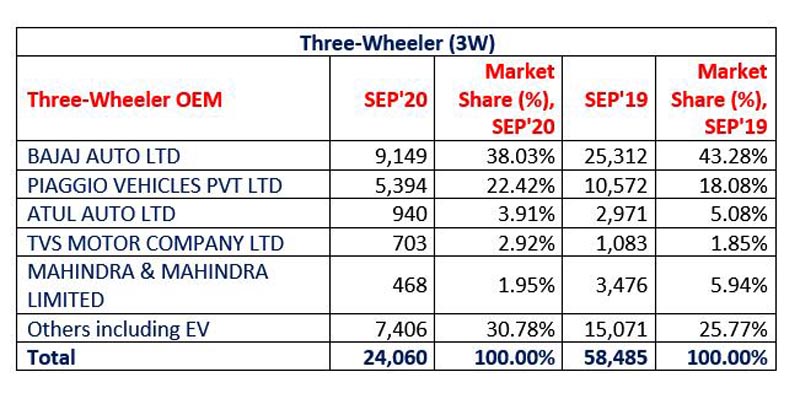

OEM-wise market share data for September’20 with YoY comparison

Source: FADA Research

Disclaimer:

1- The above numbers do not have figures from AP, MP, LD & TS as all these States/UT’s are not yet on Vahan 4.

2- Vehicle Registration Data has been collated as on 06.10.20 and in collaboration with Ministry of Road Transport & Highways, Government of India and has been gathered from 1,254 out of 1,461 RTOs.