A truck operator who wanted to own a small truck approached Shriram Transport Finance Company (STFC) to help him with finance to buy a new truck. Though he looked honest and aspiring, there was not enough equity to support his credit levels. Not having the heart to send him back, the company decided to finance him for a pre-owned truck. Very soon the operator became a pre-owned truck owner, and later bought a small truck of his own a period of operation. This was a major breakthrough in the history of STFC when it started financing pre-owned trucks.

A flagship company of the Shriram Group headquartered in Mumbai, STFC is a leading player in commercial vehicle financing, and one of the largest asset financing NBFCs in India. With its niche presence in financing pre-owned trucks and small truck owners, it has a 25 per cent market share in pre-owned and six per cent share in new commercial vehicle financing.

NBFCs have emerged as important financial intermediaries, particularly for small-scale and retail sectors. With simplified sanction procedures, flexibility, low operating cost and focused product presence, they have an edge over banks in meeting the credit needs of customers.

Established in 1979, with more than 30 years in business, STFC has added passenger commercial vehicles, multi-utility vehicles, tractors, three-wheelers and construction equipments to its portfolio and has played an incredible role in financing millions of first-time users (FTUs) and driver-turned-owners (DTOs) by offering affordable finance on pre-owned commercial vehicles.

A professionally managed company, headed presently by Mr. Umesh Revankar, its Managing Director; STFC has fostered the culture of entrepreneurship across all levels in the organization. The company is driven by more than 16,000 motivated entrepreneurs championing a unique “relationship-based” business model through a pan-India network comprising 539 branches, 350 rural centers and partnerships with more than 500 private financiers.

Being a pioneer in pre-owned CV segment, STFC has institutionalized its expertise in loan origination, valuation and collection. STFC’s subsidiary, Shriram Equipment Finance Company Ltd., offers affordable financing of pre-owned and new construction equipment; Another subsidiary, Shriram Automall India Ltd. (SAMIL), owns, operates and manages Automall to provide facilitation services to potential buyers and sellers of pre-owned commercial vehicle.

The first automall was opened in 2011. Very soon its operations expanded, and 13 more automalls were opened at Visakapatnam, Hyderabad, Jammu, Jaipur, Tirunelveli, Kolkata, Cochin, Kota, Mahabubnagar, Davangere and Mancherial. By the end of 2012 there were 21 automalls across India. SAMIL has made a net profit of Rs. 1,396 lakhs as compared to a loss of Rs. 30 lakhs the year before. STFC has also extended its services to finance tyres, engine replacement, freight bill discounting and credit cards.

A challenging year

The year 2012-13 was very challenging for the company. The sectors that traditionally motivate higher demand for commercial vehicles continued to face lower traction in terms of investments and activity. While infrastructure spending in the country remained stagnant on account of policy delays and tightening of credit by banks and financial institutions; the mining sector was badly hit by the ban imposed in key areas such as Odisha, Karnataka, etc. Moreover, the rising cost of finance had its adverse impact on the capital investment plans by corporates. To top it all, the revision in diesel prices led to higher operating cost for truck owners already hit by the recessionary trend.

However, catering to a customer segment that personally utilizes the asset to earn livelihood, demand for pre-owned vehicles remained high.

According to company sources, on a consolidated basis the net interest income during 2012-13 increased by 9.52 per cent to Rs. 3,657.84 crores and net profit by 11.8 per cent to Rs. 1,463.43 crores, on a standalone basis. The company’s income increased by 11.4 per cent at Rs. 6,563.59 crores and profit after tax by 8.2 per cent at Rs. 1,360.62 crores.

Life cycle of a CV

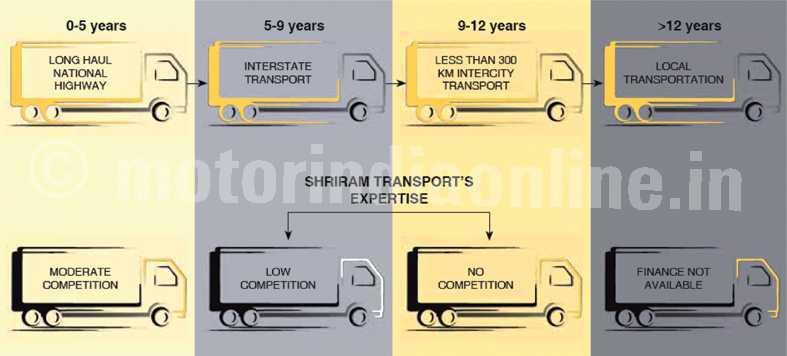

A typical nine-ton CV generally changes ownership four times in its life cycle. It starts off on the long haul national highways, moves down to inter-State by the fifth year, further on to less than 300 km inter-city routes and finally goes on to local uses like garbage trucks after 13-14 years. These changes of ownership create multiple financing options for financiers.

Considering that India has sold more than a million CVs between 2001 and 2010, this will be a huge opportunity for driver-turned-owners and first-time users to join the industry. At the same time, the existing owners of pre-owned CVs will have to change to newer pre-owned vehicles. Also, modernization of the CV industry and stricter emission norms would lead to large replacement demand for pre-owned CVs, especially in the 5-12 year-old segment.

Financing pre-owned commercial vehicles

The pre-owned commercial vehicles was traditionally an unorganized segment until firmly established by STFC as a preferred asset class, owing to its efforts over the past three decades. The pre-owned commercial vehicle financing market size is estimated to be Rs. 1,850 billion with 5.2 million vehicles. Since inception, the company has been focusing on first-time users and driver-turned owners who had no access to affordable funds.

Being first-time entrepreneurs, they had access to limited funds, which was insufficient to be offered as equity for a new CV. As a result, this segment was more inclined to buy pre-owned CVs, preferably 5-12 year-old, owing to the vast price difference. Further, the company chose to focus on the 5-12 year-old segment, which accounts for 42 per cent of the total market volume. The pre-owned CV market is largely unorganized and unexplored, with 65-70 per cent market share with private financiers, thus presenting enormous business opportunities for a sustainable long-term growth.