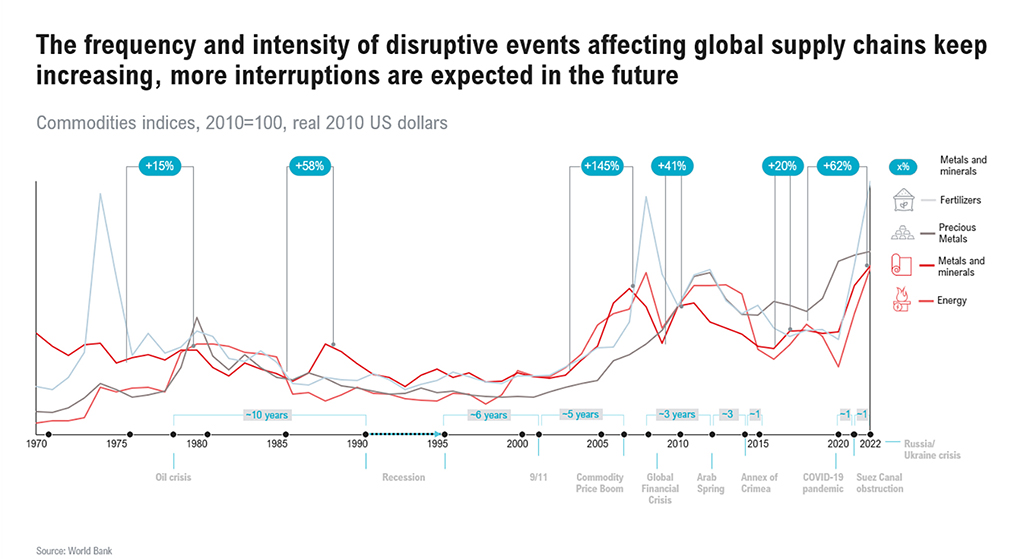

Every generation believes that it lives in extraordinary or difficult times and judging by today’s headlines, our current generation is no exception. While we may not be faced with the challenges of the founding years of the automotive industry – where the industry had to sell the concept of motorized vehicles and establish basic infrastructure for driving – or with the challenges of operating in a world war environment, we can safely state that the frequency and intensity of disruptions has dramatically increased over the last 10-15 years. Figure 1 shows that the current turbulence was preceded by a relatively calm period of 25+ years taking commodity indexes as a proxy for disruptions.

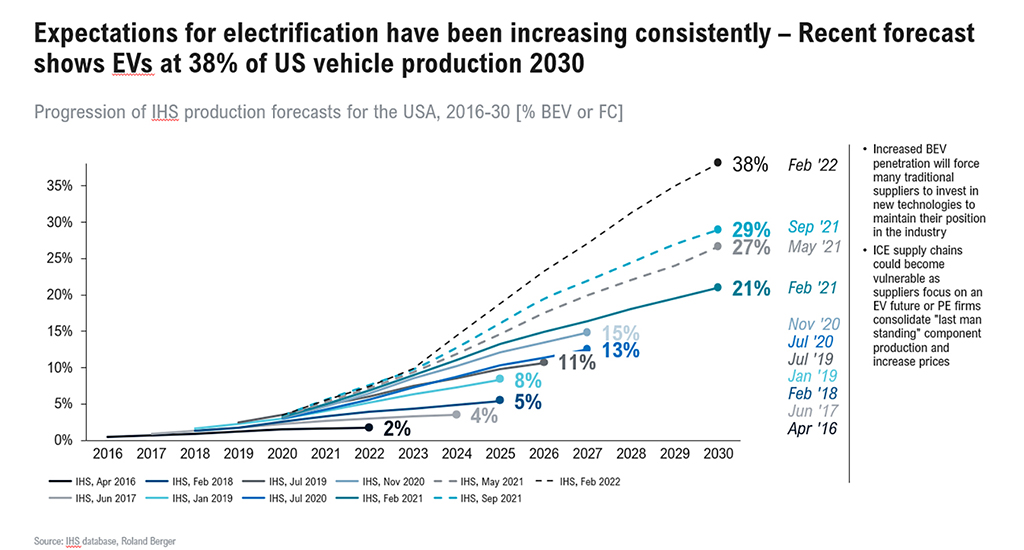

We face challenges from many directions. On the technology front, electrification proceeds much faster than previously thought as witnessed by constantly increasing EV penetration rate predictions as shown in Figure 2. Not only does this call for a determined investment in clean propulsion technology while continuing to meet the requirements of new ICE regulation such as EUVII, EPA 27 and CARB27 via expensive R&D efforts. It also threatens the stability of the supply base as passenger vehicle oriented ICE suppliers put their investment and R&D plans to a stringent review. Yet, as witnessed by the increasing intensity and probability of extreme weather events, climate change is the key challenge for humanity and will force a rapid transition of the industry away from fossil fuels. In other words, there is no respite in sight and industry players are forced to comply or, as numerous start-ups demonstrate, leverage this transition as an opportunity to establish themselves as relevant players in the industry.

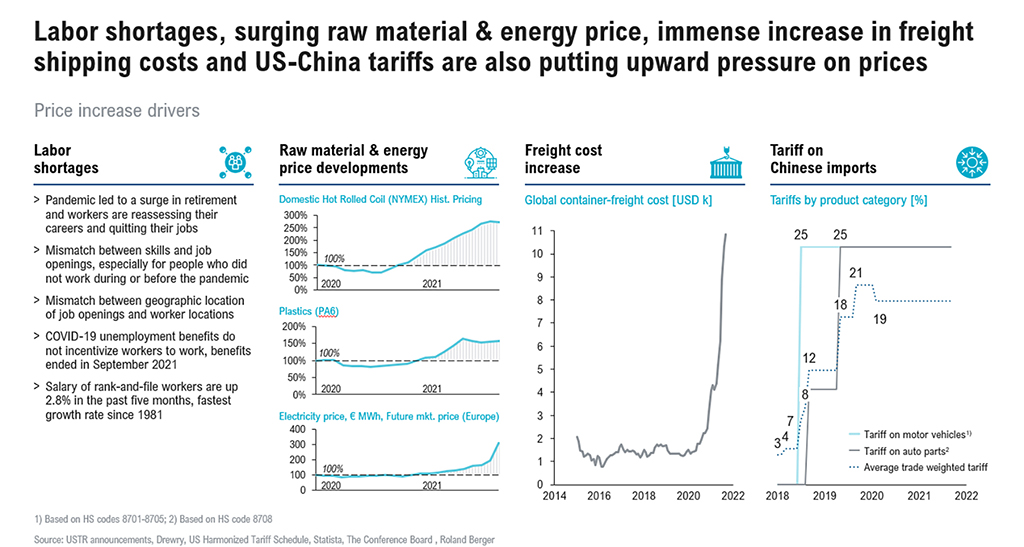

Autonomy, new digital business models and connectivity require precious R&D dollars while promising delayed returns. Financing these investment requirements with the returns from the traditional business in times of high market volatility challenges the cashflows of OEMs and suppliers alike. The recent pandemic and government interventions have made demand predictions difficult and up-/down-swings in volumes are at historic highs. Suppliers suffer not only from variations in the Commercial Vehicle and Off-Highway industry but are often hit by decreasing or stagnating PV volumes that impact profitability. Inflation is at historic highs and hits global just-in-time supply chains via dramatically increasing supply chain costs. High-inflation drives up interest rates increasing the cost of capital and constraining the investment and risk-taking abilities of companies while potentially suppressing consumer demand and increasing demand volatility.

Structural supply chain challenges such as the current semiconductor crisis impact an industry that is already under stress. With capacity additions in automotive grade semiconductors being scant and concentrated in challenging geopolitical areas, immediate improvements are unlikely and further deterioration is clearly possible. Re-shoring supply, an answer to increasing geo-political tensions as witnessed, for example, by an appalling war in Ukraine, and wide-spread supply chain disruptions, is taking center stage but will take time due to deteriorated industrial infrastructure in the West. Clearly, without massive investments in automation and re-establishment of an efficient supply chain, re- and near-shoring will increase inflation over the foreseeable future and reduce the overall standard of living.

Structural changes are not limited to technology and the supply chain. Customers are changing the way we think about logistics and the business of moving goods from A to B. Amazon, Walmart and others are investing heavily in predictive technology, e.g., via self-similar, tiered logistics networks and automated warehouses. This impacts how we transport goods, increases transportation efficiency and changes the type of products that the market needs. Tighter integration of logistics systems drives different use cases and forces OEMs to think about their customer base and value proposition differently. Power in the value chain shifts from pure product to services with a certain lack of clarity on who will finally dominate the overall value chain and capture the greatest economic gain.

How do we handle all these challenges? How do we ensure that our organizations survive and potentially thrive in these turbulent waters?

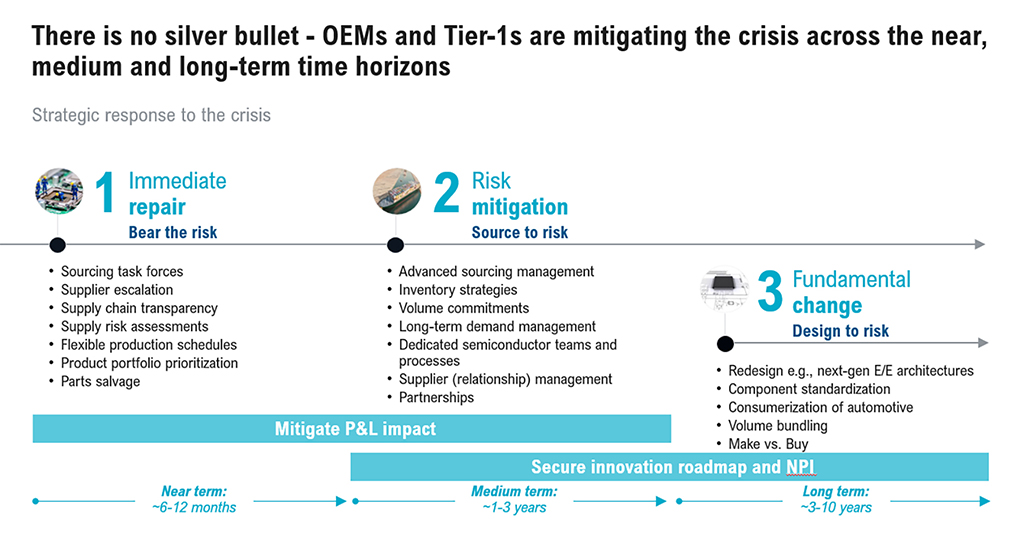

On the pragmatic side, a number of initiatives can be taken to address challenges brought about by volatility, uncertainty, complexity and ambiguity. Take the semiconductor crisis as an example. We have helped many organizations to address short-term challenges via immediate task force, mid-term actions via source-to-risk approaches, and long-term mitigating actions via design-to-risk approaches as shown in Figure X.

These approaches are necessary, but need to be embedded in a more fundamental transformation of the organization to become truly robust. Our framework for robust organizations covers the necessary organizational transformations along dimensions such as purpose, culture and strategy; ecosystems & networks; process & organizational dynamics; technology & data; leadership & talent; financing & investment. Lastly, it makes sense to look at management lessons from businesses that have lived in tumultuous environments for decades, i.e., successful companies that navigate emerging markets.1

While the road ahead is likely to be long and arduous, we have the tools to ease the journey forward.