Mergers & acquisitions (M&A) activity in transport and logistics hit a four-quarter high in the first three months of 2012, with the underlying drivers of transactions aligning to fuel $27.9 billion of completed and announced transactions.

Mergers & acquisitions (M&A) activity in transport and logistics hit a four-quarter high in the first three months of 2012, with the underlying drivers of transactions aligning to fuel $27.9 billion of completed and announced transactions.

The emerging trends suggest that 2012 is poised to be a year for accelerating global M&A activity in the transport and logistics sector. This activity will be driven by four factors:

• Significant war chests built up during the economic crisis are now ready for deployment.

• Strategic and financial investors looking to capitalise on emerging trends in high growth niche markets, including e-commerce, time and temperature sensitive delivery, and secure courier requirements.

• A need for scale and consolidation in traditional T&L segments including post, passenger transport and shipping.

• Growing demand from infrastructure investors for quality airport, port and road assets.

M&A activity has traditionally been a barometer of confidence, and on this basis the prognosis is good. The 2011 and 2010 transaction levels (measured by value and number) exhibited a return to normality over the crisis-hit 2009.

Although M&A levels in the second half of 2011 were impacted by sovereign risk-related financing uncertainty, the new year has hit a higher gear. Although short-term factors such as further fuel price shocks and debt market jitters may influence the timing of activity, it is felt that the imperatives for change are aligned to drive activity in the medium term.

This report looks at the transactions landscape in transport and logistics in 2011. It examines the driving forces behind these trends, which can be characterised as follows:

• Average transaction values lower than 2010 (particularly in North America) reflecting the distorting impact of the $36.7 billion Burlington Northern Santa Fe deal in the prior year, and the impact of “distressed M&A” particularly in H211.

• Strong growth in EMEA fuelled by a number of landmark transactions, including the divestment of TNT Express for $7.2 billion.

• EBITDA and sales multiples increasing for the third consecutive year, as EMEA multiples converge.

Reduced speed in second half

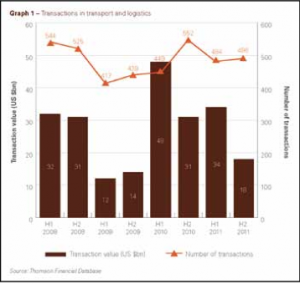

As graph 1 shows, the number of transactions in 2011 remained at a similar level to the previous year. This demonstrates that 2010 was not an exception and that the recovery from the 2009 post-recession low point appears stable.

As graph 1 shows, the number of transactions in 2011 remained at a similar level to the previous year. This demonstrates that 2010 was not an exception and that the recovery from the 2009 post-recession low point appears stable.

Indeed, the first half of 2011 recorded an increase in the total value of transactions on the second half of 2010. The second half decrease reflects the increased uncertainty and reluctance of investors in the wake of the debt crisis in the European Union.

In value terms, the 2011 average transaction size was lower than 2010. Although there were large strategic transactions in the first half of 2011, more small transactions and bail-outs (“distressed M&A”) were observed in the second half of the year, depressing average values for the year.

Despite the drop in total transaction values compared to 2010, the mergers and acquisitions market for transport and logistics remains buoyant. In 2011 M&A transactions totalled $52.1 billion, twice the equivalent figure in 2009.

The emerging trends suggest that 2012 is poised to be a year for accelerating global M&A activity in the transport and logistics sector.

Europe leads the way

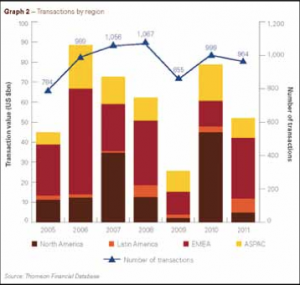

The drop in total transaction value in the transport and logistics sector in 2011 was most pronounced in the regions of Asia-Pacific (ASPAC) and North America, as shown in graph 2.

In North America the number of transactions was stable. However the total transaction value declined to $4.7 billion from $45 billion in 2010. This was exceptional in North America, due to the purchase of Burlington Northern Santa Fe by Berkshire Hathaway with a transaction value of $36.7 billion. In ASPAC there was also a (less dramatic) decrease in transaction value. In Latin America the transaction value grew significantly, albeit from a low base.

However, the major story is the increase in transaction value in the Europe, Middle East and Africa (EMEA) market. Transaction values in 2011 were $30.1 billion in comparison to $12.7 billion in 2010. The number of transactions in EMEA was very similar to 2010, indicating a number of landmark transactions in 2011. These include the divestment of the TNT Express branch for $7.2 billion; the investment of the French sovereign wealth fund, Caisse des Depots & Consignations, of 26.3 per cent in La Poste SA, with a value of $2.1 billion; and the sale of 38 per cent in equity of the Brussels airport to Ontario Teachers Pension Plan for $1.7 billion.

However, the major story is the increase in transaction value in the Europe, Middle East and Africa (EMEA) market. Transaction values in 2011 were $30.1 billion in comparison to $12.7 billion in 2010. The number of transactions in EMEA was very similar to 2010, indicating a number of landmark transactions in 2011. These include the divestment of the TNT Express branch for $7.2 billion; the investment of the French sovereign wealth fund, Caisse des Depots & Consignations, of 26.3 per cent in La Poste SA, with a value of $2.1 billion; and the sale of 38 per cent in equity of the Brussels airport to Ontario Teachers Pension Plan for $1.7 billion.

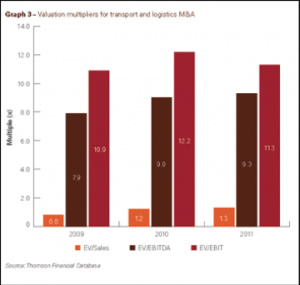

Valuation multiples of transactions (the ratio of enterprise value to sales, and EBITDA) during the last three years have increased. Valuation levels are now almost at the levels prior to the outbreak of the financial crisis in 2008. This demonstrates the increased confidence of investors in the transport and logistics sector, and the renewed appetite for mergers and acquisitions. Graph three demonstrates this.

On closer observation, however, there are large differences between the individual regions. In EMEA, for example, the valuation levels are particularly high. A trend toward increasing valuation levels can also be seen in North America and ASPAC, albeit somewhat less dramatic than Europe. Despite an increase in total deal value in Latin America, the valuation levels are decreasing.

In North America and EMEA it can be seen that in 2011, the EBITDA and EBIT multipliers have converged so that they are now almost identical to each other. This shows that in 2011, a number of key transactions in these regions related to asset-light companies.

Outlook for 2012

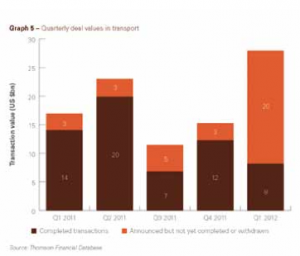

The first quarter of 2012 showed growing M&A activities in the transport sector compared to the second half of 2011. This can be clearly demonstrated in graph 5.

Overall, 177 transactions with a total value of $8.2 billion have been completed. A further 147 mergers and acquisitions with a total value of almost $20 billion have been announced in the first quarter of 2012 representing a significant increase on 2011.

Again, Europe has been the centre of M&A activity, with the largest number of transactions completed in quarter 1.

Again, Europe has been the centre of M&A activity, with the largest number of transactions completed in quarter 1.

To make this strong start to FY12 sustainable, three key factors must be taken into consideration:

Confidence in sustainable economic recovery: This depends mainly on continued market trust in the solutions to the European debt crisis. Should the economic outlook remain stable, business activity could improve as early as the second half of 2012.

Investment pressure on investors: The pressure on financial investors to deliver strong returns is high following a disappointing year in 2011. However, many private equity firms are finding it difficult to attract financing, and the ability to attract new financing will be a key factor in the outlook for 2012.

M&A appetite of strategic investors: The M&A appetite of transport and logistics firms is often correlated with their debt capacities. This is higher than in previous years. In particular, companies in the logistics and express segments currently have deep pockets and stand ready for more strategic acquisitions. This has been recently evidenced by UPS’ acquisition of TNT Express.

The key sectors to watch are shipping and logistics. In the global shipping market, the outlook for the year is bleak, with overcapacity expected to remain. As a result, there is likely to be further need for consolidation through distressed M&A, though the transaction sizes will be reasonably small.

The key sectors to watch are shipping and logistics. In the global shipping market, the outlook for the year is bleak, with overcapacity expected to remain. As a result, there is likely to be further need for consolidation through distressed M&A, though the transaction sizes will be reasonably small.

The logistics market, particularly in Europe, remains fragmented. Private equity investors looking to invest in niche markets, and the ongoing need for consolidation are likely to drive M&A activity in this sector. Should the trend established in quarter 1 continue, 2012 could be an exciting year for transport and logistics.