While there has been an unprecedented entry of multinationals into the Indian automotive industry, be it vehicle manufacturers, component suppliers, or other service providers, there have been some home-grown companies who have defied the odds, expanded boundaries, and grown to scale of being called multinationals themselves. Some have been in the limelight a lot while there have been some others, who have been silent champions. The Varroc Group could be called a silent champion, probably until it ventured out to acquire Visteon’s global lighting business in mid-2012, which straight away almost doubled its turnover and more importantly gave it access to technology and a customer base, both truly global.

We spoke to Dr. Ravi Damodaran, President – Technology & Strategy and Dr. Arvinder Singh Gill, Group Vice President – Business Development, Varroc Group, to get details on recent developments at the Group, its new synergistic strategy and from a long-term stance, its vision for 2020.

The Varroc Group is a preferred system solutions provider in the Indian market, supplying plastic-moulded modules, engine valves, machined forgings, exterior lighting and electrical systems to a wide range of customers in the country and also many others outside. Established in 1990, the Group currently operates globally from 33 manufacturing plants and eight technical and development centers across three continents and 10 countries globally. Varroc, which believes ‘excellence is a habit’, is today among the top three auto component manufacturers in India. The Group has set itself a vision for 2020 – improve its overall turnover from Rs. 7,000 crore in FY14 to Rs. 20,000 crore by FY20.

According to Dr. Ravi: “We have a clear strategy in place towards the year 2020 as part of which our product diversity and growth in the domestic market will take us to a turnover of Rs. 8,000 crore from the Indian business, from the Rs. 20,000 crore turnover targeted for the entire Group by 2020.” Further adding to this, Dr. Gill says: “This would be possible when our new facilities come up as per plan (three more in India by next year) and all our customer orders are on track. Our diverse customer base and product portfolio guarantees that if the market grows at a particular pace, then we either grow at the same pace or at a better pace. Thanks to our focused efforts in the last few years, we have de-risked our future growth model.”

System solutions supplier

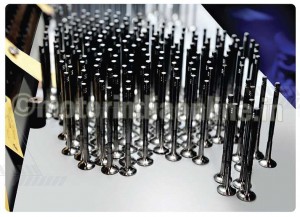

Headquartered at Aurangabad, Varroc had started off as a supplier of components for Bajaj two-wheelers. It currently operates as two entities namely Varroc Polymers Pvt. Ltd. and Varroc Engineering Pvt. Ltd., with the latter including five divisions – Polymers including Elastomer business, Electricals & Electronics, Metallic, Varroc Lighting Systems (VLS) and Triom two-wheeler lighting. The polymers business, one of Varroc’s strongest, makes plastic interiors, under body parts, assemblies for mirrors, air filters and seatings. The electrical and electronics division works on developing electronics, handle bar assemblies, motors and magnetos, etc. On the lighting front, while Triom caters to the global top-end two-wheeler makers, the VLS division offers complete lighting solutions for four-wheelers and commercial vehicles, both in India and abroad. Varroc’s metallic business involves the manufacture of forgings, engines valves, hydraulic components and other products with keen focus on the commercial vehicle space.

Varroc also has a separate Aftermarket Division (AMD) in India which has been growing at around 30 per cent annually for the last few years. Through its network of over 300 distribution points spread across the globe, the company offers almost all its products for retrofit, the main ones being electricals and engine valves. The increase in share of its patented products has given Varroc’s aftermarket operations a big boost, with the company viewing the AMD as an exciting prospect for growth.

Says Dr. Ravi Damodaran: “Around 15 years back, the number of proprietary products we had was very less. This is a lot different now as we have a lot of proprietary products in our range, and so we are witnessing strong growth in the AMD, since the aftermarket performance depends a lot on the exclusivity of products. The AMD is one of the most exciting divisions at Varroc at present.”

Wider presence

Varroc has grown rapidly and expansively in terms of both product offerings and customer base and has shed off its ‘two-wheeler supplier’ image to a large extent. Though still over 75 per cent of the its Indian operations turnover comes from two-wheelers, it has roped in many other customers in the segment including Honda, Suzuki, Hero and Yamaha, among others, apart from making an aggressive entry into the four-wheeler and commercial vehicle arena, gaining the acceptance of names such as Tata Motors, Mahindra, Fiat, GM, Volkswagen, Ashok Leyland, VECV, Piaggio, and many more. Also, over 50 per cent of Varroc Group’s business is from overseas operations, wherein it caters to top brands such as Ford, GM, Chrysler, JLR, etc.

Although a relatively new entrant in the four-wheeler and CV segments, compared to two-wheelers, one of Varroc’s growth directions is to expand its presence in the segments. “In 1997, we forayed out of the two-wheeler segment by supplying engine valves to Fiat Group’s export vehicles and that gave us an entry into the four-wheeler space. We have been growing very rapidly ever since and are becoming lead suppliers in individual categories to some customers, focusing on increasing our share of components and systems supplied per vehicle. Around 25 to 30 per cent of our Indian business turnover will come from four-wheelers and CVs by 2020”, says Dr. Damodaran.

Although a relatively new entrant in the four-wheeler and CV segments, compared to two-wheelers, one of Varroc’s growth directions is to expand its presence in the segments. “In 1997, we forayed out of the two-wheeler segment by supplying engine valves to Fiat Group’s export vehicles and that gave us an entry into the four-wheeler space. We have been growing very rapidly ever since and are becoming lead suppliers in individual categories to some customers, focusing on increasing our share of components and systems supplied per vehicle. Around 25 to 30 per cent of our Indian business turnover will come from four-wheelers and CVs by 2020”, says Dr. Damodaran.

Complementing his colleague’s views, Dr. Gill is quick to add: “We are relatively new in the passenger car and CV segments, which means our growth will be fast. Our four-wheeler business has taken-off very strongly. Apart from our existing CV customers, we are also in talks with Daimler (BharatBenz) for providing system solutions. We more or less offer a range of solutions for CVs – polymers, engine valves, crank shafts and cam shafts – and this is gaining the acceptance of many OEMs. As we move forward, we see this as a very good opportunity for growth and also to showcase our group capabilities and combined strengths.”

Technology – a key USP

When it comes to strengths and USPs, the immediate thought would be Varroc’s competences as a group, the ability to become a one-stop-shop solution for customers. The next major aspect is its strong geographic presence, with locations in almost every important automotive hub across the country. Without doubt, Varroc’s diverse product portfolio adds to its credibility and face-value in front of customers but the company does not wish to stay contented with what it has to offer. “Technology at affordable cost” is one of the main focus areas and growth-drivers at Varroc, says Dr. Damodaran. He adds: “From a customer view point, technology plays a big role, especially in a growing market. India is very conscious of the price to be paid for technology whereas in markets like China, you could just transplant a technology from other developed markets. In India, you could de-content products but at most times it requires dedicated development. We at Varroc are positioning ourselves as a supplier which makes an advanced technology affordable to the Indian customer. We have our own development group and access to technology through our international operations, and we work closely with our customers on specific product lines to understand local market needs, in order to be able to offer technology at affordable cost.”

Apart from building internal capabilities to develop affordable technology, Varroc has also partnered institutes and design houses to facilitate and fasten the process of new technology development. “We have tied up with a world-renowned institute in Germany to develop new technology for our metallic division. Varroc will own the Intellectual Property (IP) of the technology developed as a result of the cooperation. The partnership has been active for a year and half and currently is going strong. We are also working with some Indian design houses on developing new design and technology. The main aim of such partnerships is to reduce the gestation period for new technology so that we could offer them quickly to our customers”, shares Dr. Damodaran.

Apart from building internal capabilities to develop affordable technology, Varroc has also partnered institutes and design houses to facilitate and fasten the process of new technology development. “We have tied up with a world-renowned institute in Germany to develop new technology for our metallic division. Varroc will own the Intellectual Property (IP) of the technology developed as a result of the cooperation. The partnership has been active for a year and half and currently is going strong. We are also working with some Indian design houses on developing new design and technology. The main aim of such partnerships is to reduce the gestation period for new technology so that we could offer them quickly to our customers”, shares Dr. Damodaran.

Technology as a priority is gaining importance in the Indian market. But though forward-looking enterprises like Varroc are actively involved in bringing new technology into the market, it is also up to other stakeholders including the government, the vehicle manufacturers and the end-customer to raise the technology bar to new heights. India, despite being a cost-conscious market, has seen reasonable evolution when it comes to technology and also in terms of another critical aspect – safety. While the Indian vehicle makers have been doing their part to support the cause, the influx of multinationals has further facilitated this progress. From Varroc’s side, despite the various challenges around, it is actively working on new technology in line with three key megatrends namely light-weighting, safety and emissions.

Upswing ahead

As part of the changing scenario in the Indian auto component supplier industry, vehicle OEMs are increasingly moving away from a dual- or multi-sourcing policy to a single-sourcing approach in order to leverage on benefits such as easier logistics, reduction in investments for tooling, reduced cost due to increase in volumes from the same vendor, etc. The supplier in turn could leverage on reduced cost for raw material purchase as its volume goes up and also gets the reward of bigger customer orders. At such a juncture, Varroc Group’s capabilities combined with its other strengths could help it outrun competition.

“Initially, the vehicle OEMs wanted multiple sources for each product owing to differences in technology, access and process capabilities of their vendors. The Indian vendor base has now reached a level where we know how to manufacture a good product and how to sustain and improve. So, the OEMs are no longer looking for multi-source for the same component, though the policy of one supplier for one vehicle model is still common”, says Dr. Gill. Ask him as to why customers would go for Varroc and Dr. Gill explains: “There are many reasons as to why OEMs will choose us over competition. Our relationship with our customers is the first one. We make sure that our quality, delivery, and cost are all well-aligned and this takes us long-term. Our manufacturing footprint is important as well because as OEMs expand locations, they prefer taking their suppliers with them. So, the ability to invest when our customer moves to a new location is another major advantage at Varroc.”

“Initially, the vehicle OEMs wanted multiple sources for each product owing to differences in technology, access and process capabilities of their vendors. The Indian vendor base has now reached a level where we know how to manufacture a good product and how to sustain and improve. So, the OEMs are no longer looking for multi-source for the same component, though the policy of one supplier for one vehicle model is still common”, says Dr. Gill. Ask him as to why customers would go for Varroc and Dr. Gill explains: “There are many reasons as to why OEMs will choose us over competition. Our relationship with our customers is the first one. We make sure that our quality, delivery, and cost are all well-aligned and this takes us long-term. Our manufacturing footprint is important as well because as OEMs expand locations, they prefer taking their suppliers with them. So, the ability to invest when our customer moves to a new location is another major advantage at Varroc.”

Dr. Damodaran chips in by stating: “The speed and flexibility of developing products and technology is another major strength of Varroc. Indian customers expect a lot of flexibility and so when a customer wants us at their place, we are there. This has helped us in the past, and it will continue in future too.”

Running into 2015, Varroc expects to consolidate its customer and product base to an extent that its system and component contribution to any vehicle platform – two-wheeler, four-wheeler or commercial vehicle – would have gone up. Its focus would be on utilizing its group synergies to offer complete solutions to its customers. The company expects to add at least three to four reputed names to its customers list and ensure it supplies a sizeable share of systems and products to each of them.

With well-defined directions such as widening customer base, combining group capabilities to offer complete system solutions, developing technology at affordable cost, utilizing global resources to bring in new technology faster and staying close to customers, few would dare to doubt that Varro Group is well on its way to reaching its turnover target of Rs. 20,000 crore by 2020.