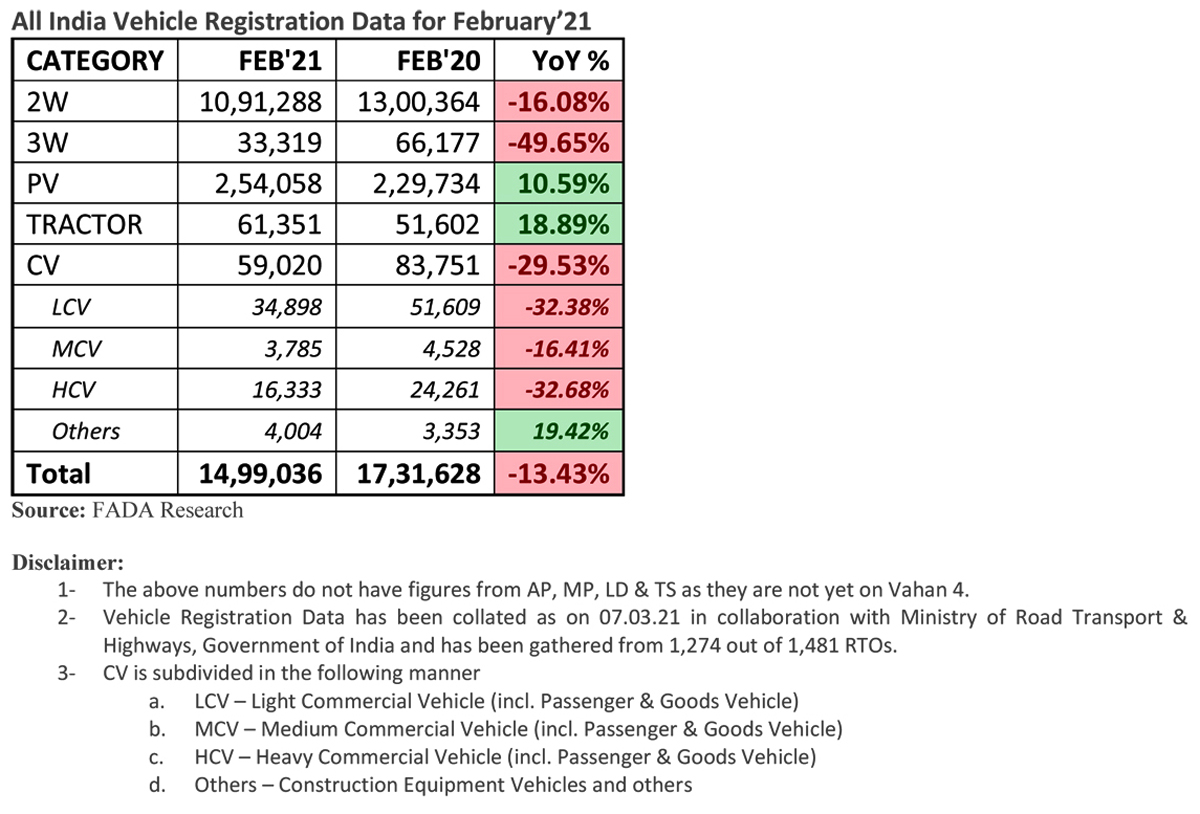

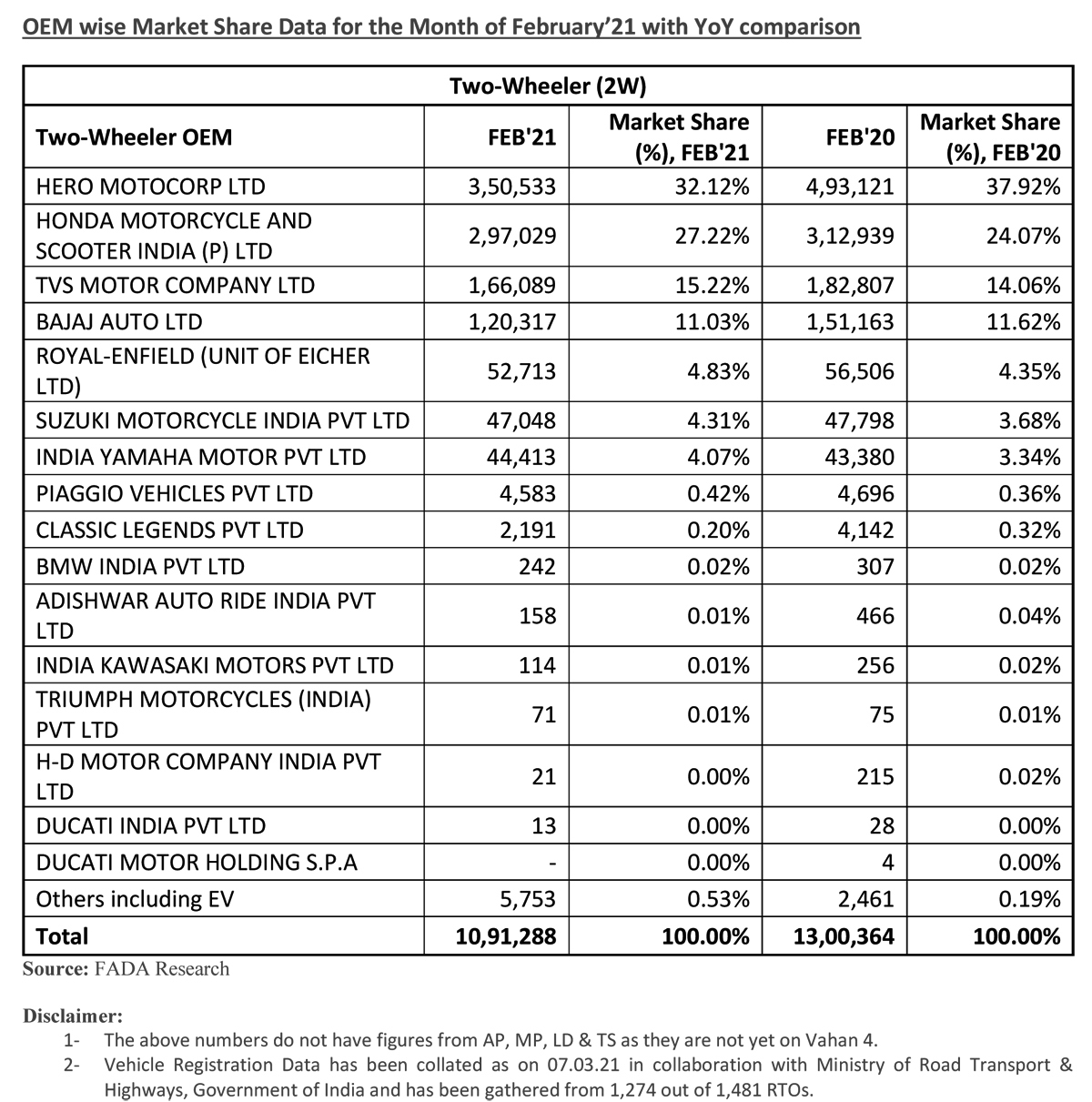

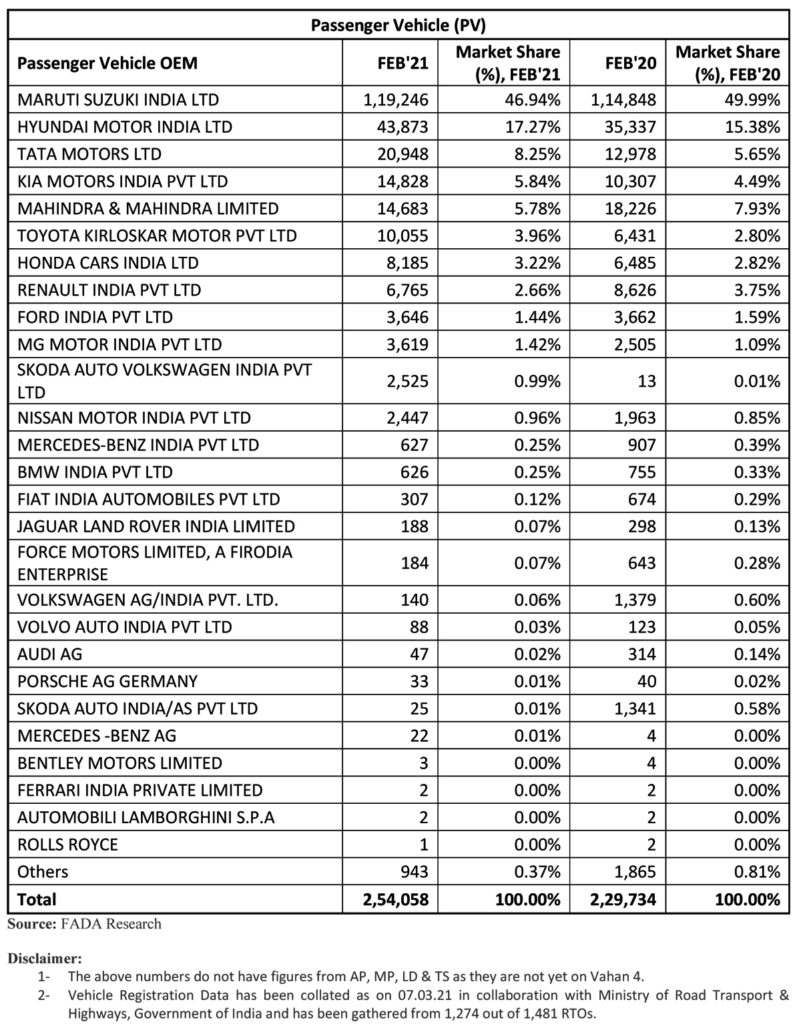

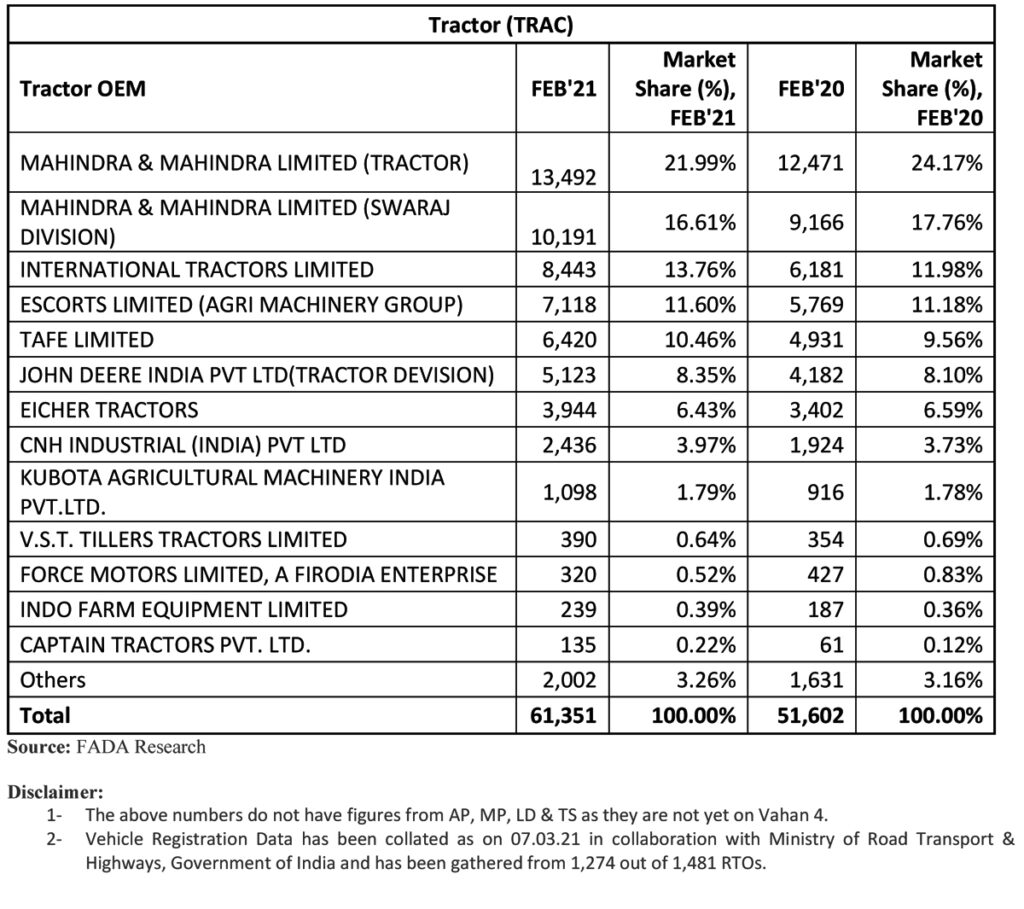

The Federation of Automobile Dealers Associations (FADA) has released the Monthly Vehicle Registration Data for February’21. Registrations for the month fell by -13.43% YoY. While Tractors continued its positive momentum by growing 18.89% YoY, Passenger Vehicles also showed double digit growth at 10.59% YoY. This growth was majorly due to low base of last year as India had started transitioning from BS-4 to BS-6 emission norms.

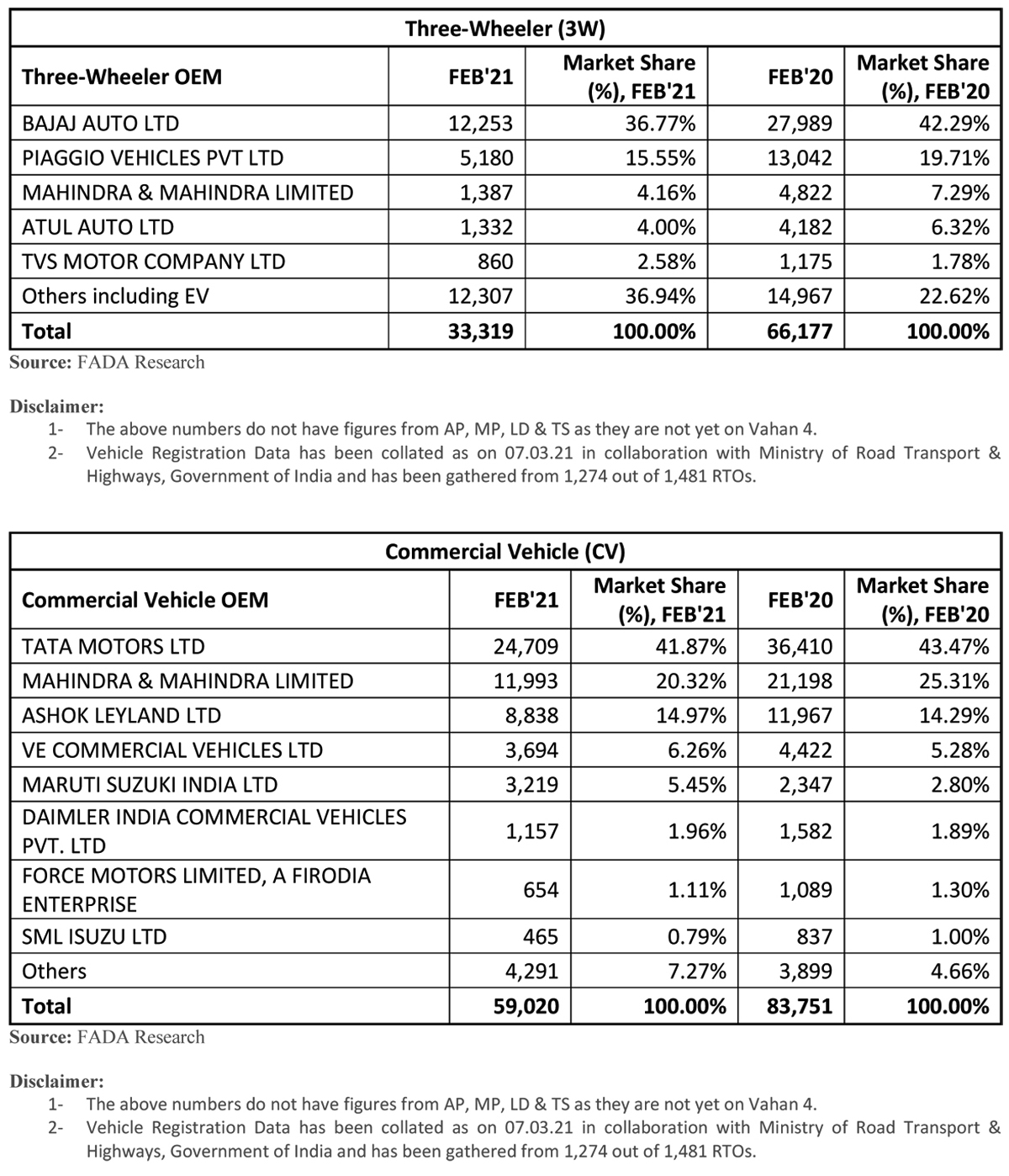

On a YoY basis, 2W, 3W and CV continued their fall by -16.08%, -49.65% and -29.53% respectively. Passenger vehicle waiting period continued to remain as high as 8 months as scarcity of semiconductors continued to linger around. Dealer inventory for PV and 2W remained in range of 10-15 and 30-35 days.

The auto retail industry continues to await the fine prints of Voluntary Scrappage Policy. The industry also urges the Government to intervene and solve the semiconductor issue which is hampering automobile manufacturing and sales, thus threatening post pandemic economic recovery.

Commenting on the February’21 registration data, FADA President Vinkesh Gulati, said: “Auto registrations continued to fall in double digits by -13.43% YoY in the month of February. While Tractors maintained their outperformance compared to the broader market, Passenger Vehicles witnessed double digit growth on low base of last year as India started transitioning from BS-4 to BS-6 emission norms. This coupled with the global semiconductor outrage kept waiting period of PV as high as 8 months. FADA Survey showed that 50% PV Dealers lost 20% + sales due to non-availability of vehicles.

2W continued to see sluggish demand as the new wave of COVID in certain states kept customers away. Enquiry levels also narrowed as many educational institutions were still reluctant to open. Fuel prices are at its historic high and has put a dampener in sentiments. This in-turn has pressed brake on sale of entry level price sensitive category.

Overall CV segment continues to falter as availability of finance, negligible sales of passenger buses due to closure of educational institutes and supply side constraints kept the registrations in deep red. LCV’s which saw good pent-up demand during last few months post unlocking has now started to fall flat. Tippers and HCV’s are in-turn showing initial signs of revival as Government’s infrastructure push has started creating its demand.”

Near Term Outlook

India’s economy resurfaced to growth territory in the third quarter of FY20-21, clocking 0.4% rise in the GDP. India’s farm sector remained resilient, clocking a 3.9% growth in Gross Value Added (GVA) to the economy, after recording 3.3% and 3% rise in the first two quarters. Tractor registrations will hence continue to outperform overall registrations in near term.

The fuel consumption which had almost recovered from the lows of pandemic is once again witnessing headwinds due to historic price hikes. This will have a negative impact on 2W and CV sales.

Consumer spending, which is the driving force behind India’s economy and accounting for 60% of the GDP, fell 2.4% showing signs of sluggishness despite the quarter being in the festive season. This also reflects that consumers are still uncertain and worried about their income and cautious about spending.

India’s growth engine will only see full recovery depending on the pace of the world’s largest vaccination programme. A rapid increase in new COVID cases will thus reduce the pace of recovery and hence impact overall Auto demand.

While FADA is thankful to the Hon’ble Finance Minister for announcing the Voluntary Scrappage Policy, it continues to await the fine prints of the same. The Federation also urges the Union Government to hold diplomatic discussions with countries manufacturing semi-conductors (Taiwan & other similar countries) so that the momentum which was built thus far in Auto sales is not lost and Auto Industry continues to fuel the recovery process. Overall, FADA continues to remain guarded in its optimism for vehicle registrations in March.

Key Findings from our Online Members Survey

- Sentiments

- 51.9% dealers rated it as Good

- 33.3% dealers rated it as Neutral

- 14.8% dealers rated it as Bad

- Liquidity

- 49.6% dealers rated it as Good

- 36.7% dealers rated it as Neutral

- 13.7% dealers rated it as Bad

- Expectation in March

- 55.9% dealers rated it as Growth

- 24.8% dealers rated it as Flat

- 19.3% dealers rated it as De-growth

- Inventory

- Average inventory for Passenger Vehicles ranges from 10 – 15 days

- Average inventory for Two-Wheeler ranges from 30 – 35 days

Chart showing Vehicle Registration Data for February’21 with YoY comparison can be found below: