The Federation of Automobile Dealers Associations (FADA) has released the monthly vehicle registration data for January’21.

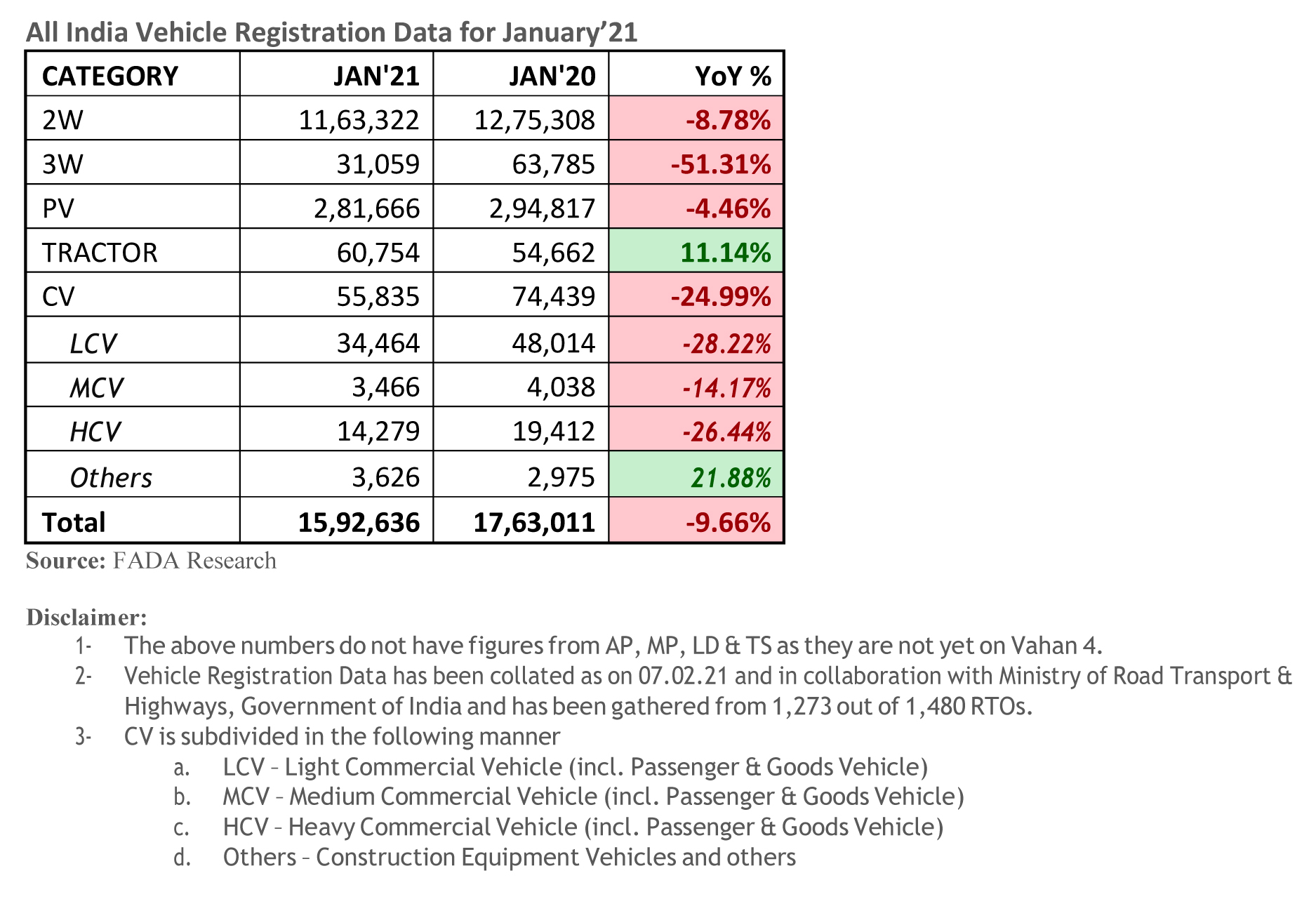

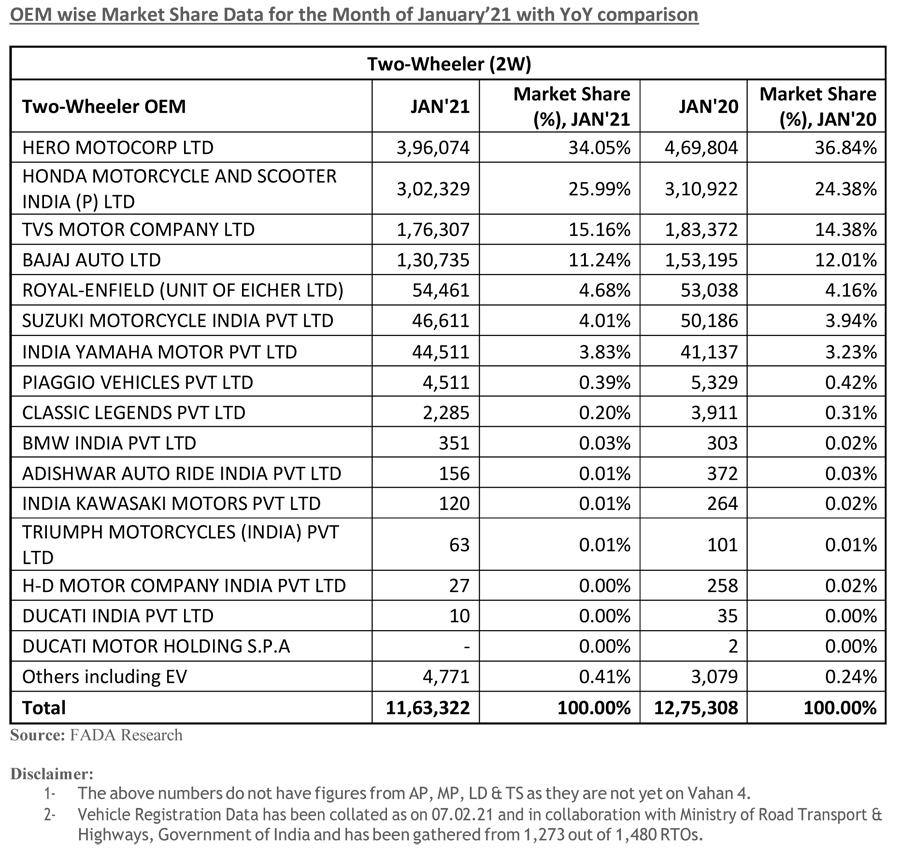

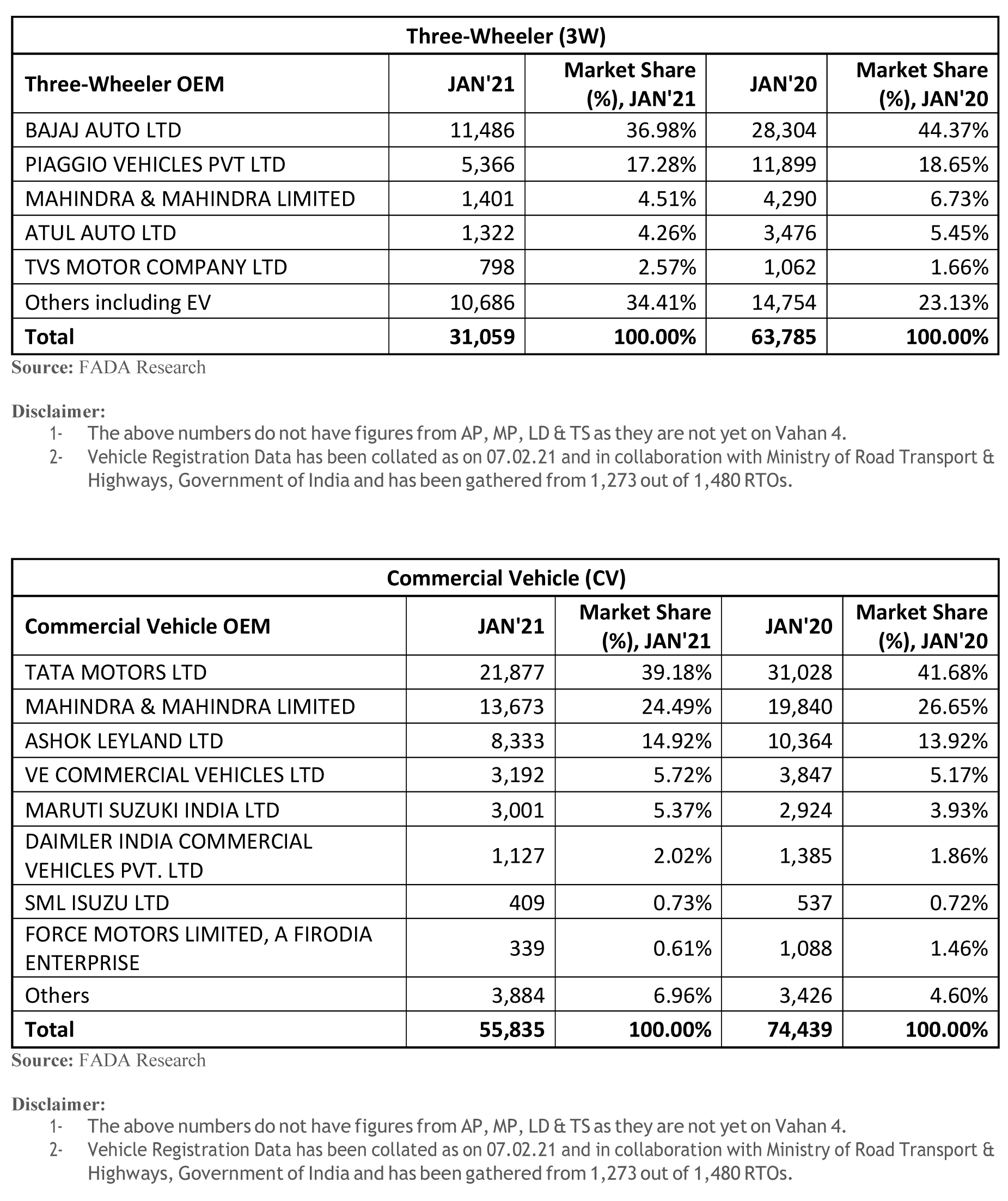

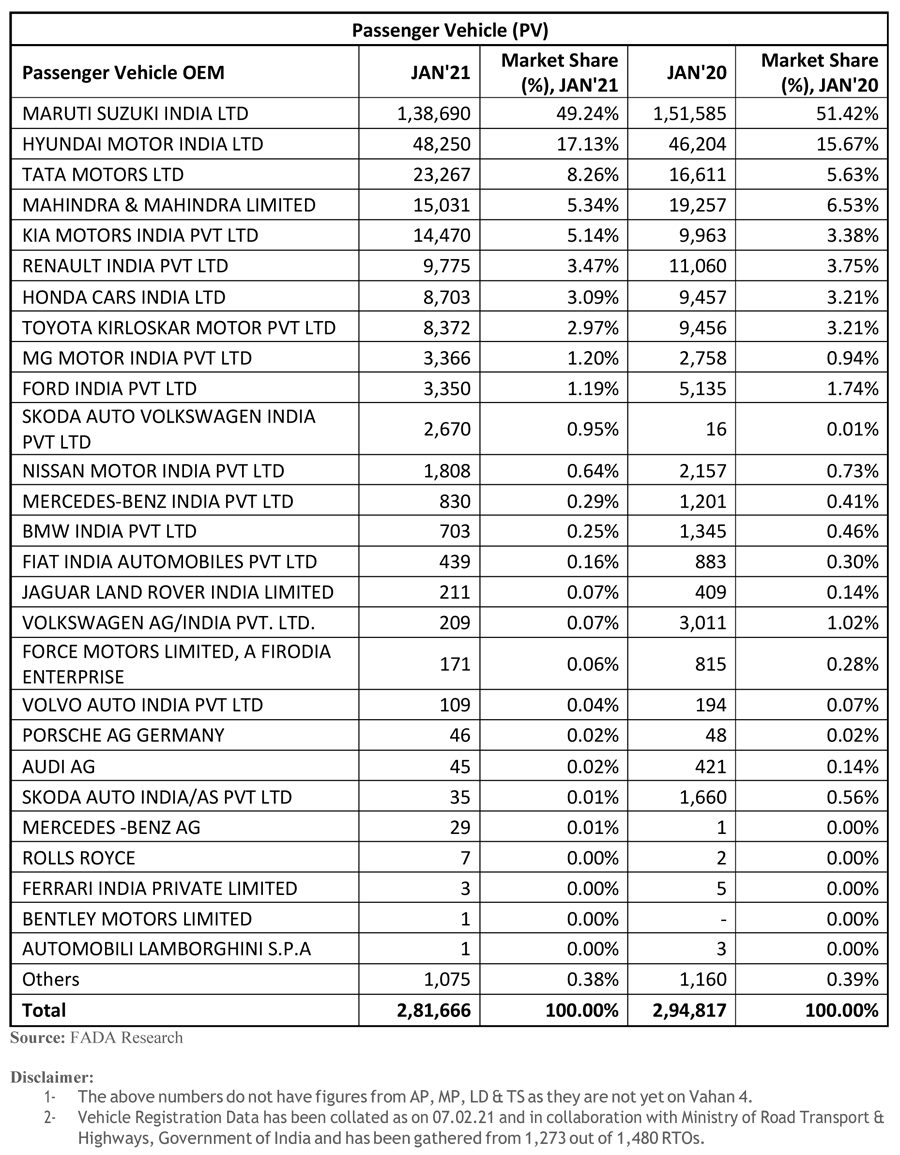

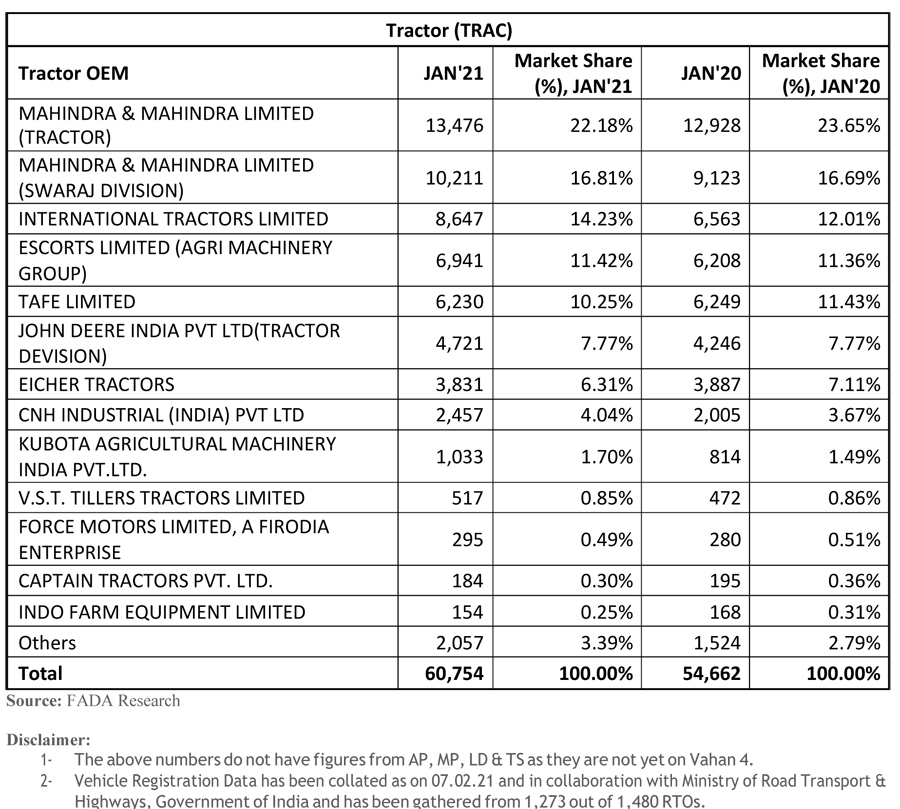

After showing a one-time YoY growth in December, January registrations once again fell by -9.66%. All categories except Tractor were in red. On a YoY basis, 2W, 3W, CV and PV fell by -8.78%, -51.31%, -25% and -4.46%. Tractor continued its upbeat momentum with a YoY growth of 11.14%. Non-availability of vehicles due to scarcity of semiconductors, a fading pent-up demand and recent price hikes coupled with no festivities and auspicious days landed January registrations in negative zone. While dealer inventory for PV continued to fall and came down in range of 10-15 days, 2W inventory stayed put at 30-35 days. According to FADA, the Union Government’s announcement of scrappage policy (though voluntary) is a step in the right direction while the spend on infrastructure projects like roads and public transport will help build traction for commercial vehicles over a longer period of time.

Commenting on how January’21 performed, FADA President, Vinkesh Gulati, said: “After witnessing a one-off growth in December, January Auto Registrations fell once again by ~10% YoY. Auto Industry clearly misjudged the demand which returned post lockdown. Industry’s under estimation of post- COVID rebound along with chipmakers prioritizing higher-volume and more lucrative consumer electronics market has created a vacuum for semiconductors. This has resulted in shortage in supply for all categories of vehicles especially Passenger Vehicles even though enquiry levels and bookings remained high. New launches and SUV’s continued to see high traction and helped in restricting the overall PV registrations fall by a bigger margin.”

He added, “The recent price hike undertaken by auto OEMs also added to woos as two-wheeler have become more expensive for lower and middle income class. Commercial vehicle registrations were also hit due to vehicle financing still not back to normal and high BS-6 cost.”

Near-Term Outlook

The first budget of this decade stressed on making India an Aatmanirbhar Bharat. Union Budget 2021 finally brought smile for Auto Industry as its age-old demand of bringing vehicle scrappage policy (voluntary) saw light of the day. The final contours of the policy though awaited, will decide its attractiveness and popularity. This including announcement to induct more buses in public transport, increased infrastructure spending and building national highways will play a pivotal role in reviving commercial vehicles segment over a longer period of time.

Last year, the auto industry was transitioning from BS-4 to BS-6 during Q4 FY’21. This saw huge discounts leading to higher sales and registrations. With a high base and continued shortage of semiconductors on one hand and gradual opening of academic institutes and business as usual along with COVID vaccine’s effectiveness on the other, FADA continues to remain guarded in its optimism for auto registrations during Q4 of this financial year.

Key Findings from our Online Members Survey

- Sentiments

- 46% dealers rated it as Good

- 35.3% dealers rated it as Neutral

- 18.8% dealers rated it as Bad

- Liquidity

- 45.6% dealers rated it as Good

- 38.2% dealers rated it as Neutral

- 16.2% dealers rated it as Bad

- Expectation in February

- 41.1% dealers rated it as Growth

- 34.6% dealers rated it as Flat

- 24.3% dealers rated it as De-growth

- Inventory

- Average inventory for Passenger Vehicles ranges from 10 – 15 days

- Average inventory for Two-Wheeler ranges from 30 – 35 days

Chart showing Vehicle Registration Data for January’21 with YoY comparison can be found below: