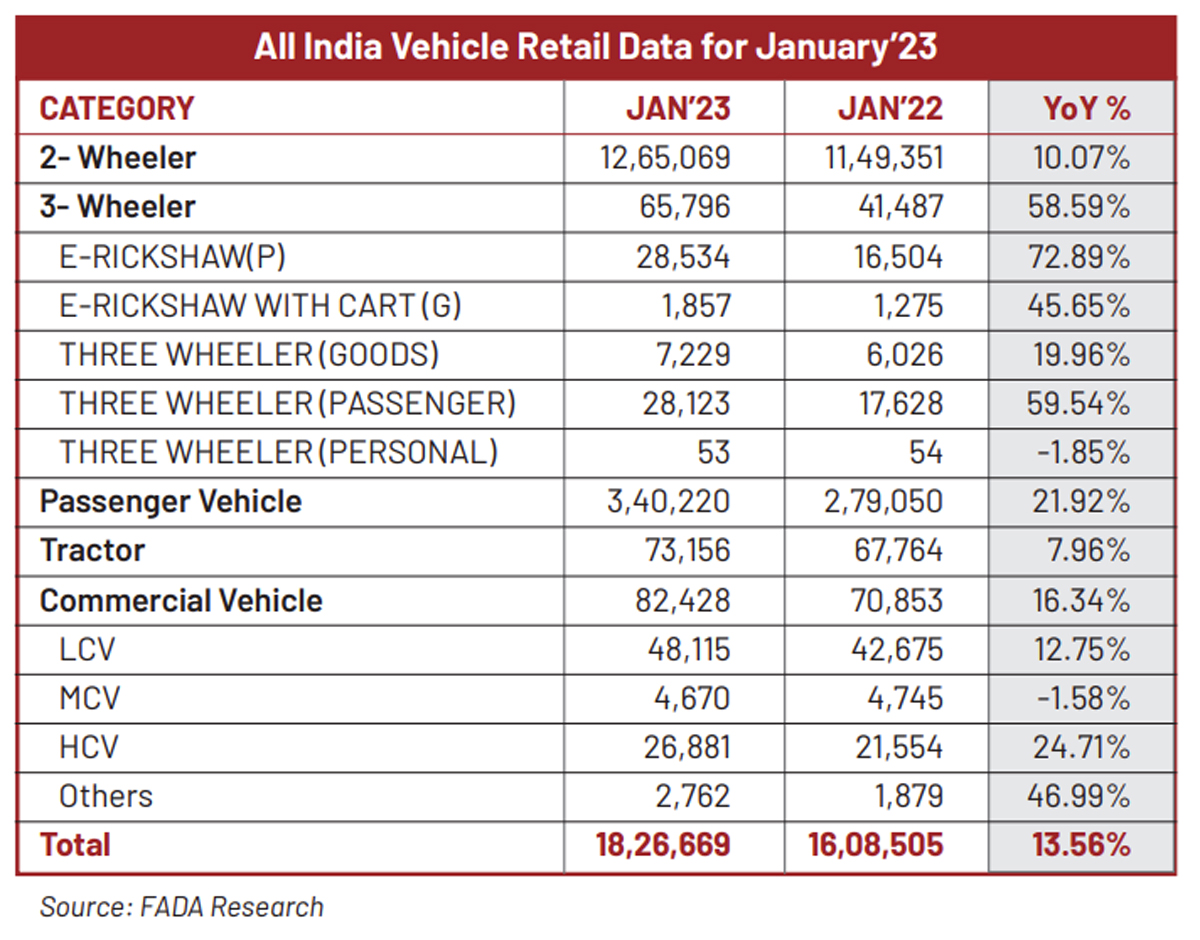

The Federation of Automobile Dealers Associations (FADA) has released vehicle retail data for January 2023, indicating that the total vehicle retail for January grew by 14% year-on-year (YoY). All categories were in green with two-wheelers, three-wheelers, passenger vehicles, tractors and commercial vehicles growing by 10%, 59%, 22%, 8% and 16%, respectively.

While the two-wheeler segment showed growth on YoY basis, it fell by 13% when compared to the pre-pandemic level of January 2020. This clearly shows that rural India is still not out of the woods. The three-wheeler segment has shown tremendous resilience and has almost clawed back to the pre-pandemic levels with de-growth of a mere -3% when compared to January 2020.

The passenger vehicle category continues to see robust growth despite entry level sub-segment which is yet to fire. Both tractors and commercial vehicles continue to grow above the pre-pandemic levels of January 2020 by growing 9.5% and 6%, respectively.

On the global front, China’s re-opening will help better the supply chain, thus improving supply of vehicles and reducing vehicle waiting period. The Union Budget 2023-24 will aid the overall growth of automobile retail in times to come, according to FADA.

Commenting on the sales data, FADA President Manish Raj Singhania said, “January witnessed total retail rising by 14% YoY but was still down by 8%, when compared to the pre-pandemic month of January 2020. All categories were in the green with two-wheelers, three-wheelers, passenger vehicles, tractors and commercial vehicles growing by 10%, 59%, 22%, 8% and 16%, respectively, on YoY basis. The two-wheeler category showed a growth of 10% YoY but when compared to 2021 and the pre-pandemic month of January 2020, it continued to see pressure as the same fell by 7% and 13%.”

“While sentiments are improving at a snail’s pace and are better than what they were a year ago, the rural market is yet to fully come to the party as cost of ownership has shot up significantly while disposable income has not increased in the same ratio,” he added. The three-wheeler segment has seen 60% growth YoY, 101% growth when compared to 2021 and is now slightly down by mere 3% when compared to the pre-pandemic levels in January 2020. EV Fame II subsidy along with demand from commercial three-wheeler space is fuelling healthy growth. The passenger vehicle segment continues to perform well with growth of 22% YoY, 10% from January 2021 and 8% from the pre-pandemic month of January 2020.

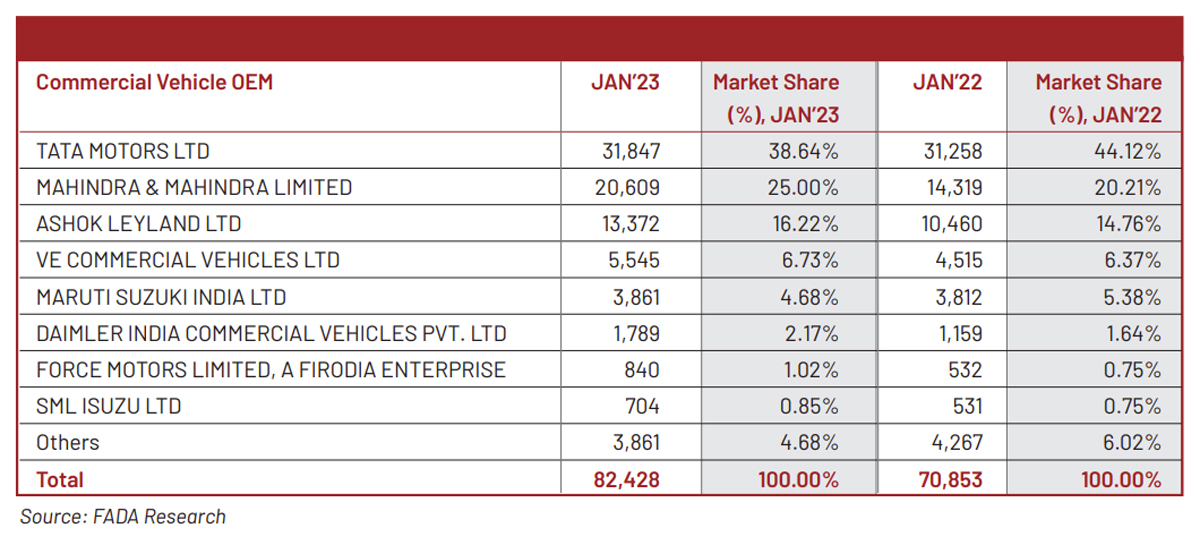

While good enquiry, healthy bookings and improved supplies are helping aid this segment, it is the entry level sub-segment which is still feeling the pinch. Apart from this, while the waiting period for some models have come down, compact SUVs, SUVs and luxury vehicles continue to witness minimum waiting of 2-3 months. The commercial vehicle category has also shown robust growth by growing 16% YoY, 23% from January 2021 and 6% from the pre-pandemic month of January 2020. Continued demand in the market due to replacement of fleet, growth in freight availability and the government’s consistent push for infrastructure projects has helped the CV segment rise above the pre-pandemic numbers.

Near Term Outlook

With China’s factory activity once again gaining pace, global supplies of parts and semi-conductors will see a recovery, thus aiding better vehicle supplies and lower waiting period in the future. This will further fuel growth for the already healthy passenger vehicle category. The Economic Survey 2022-23 tabled in the parliament said that rural wages will rise at a steady positive rate as inflation is expected to soften, thus translating into a rise in real wages. “We are hopeful that this will have its rub-off effect with rise in two-wheeler sales going ahead. The recent announcements in Union Budget 2023-24 will help aid the overall growth of automobile retails,” Singhania said.

The demand of entry level two-wheelers and entry level passenger vehicles is likely to accelerate due to enhanced Income Tax rebate, budget allocation for vehicle scrapping policy and import duty exemption for manufacturing Lithium batteries, thus reducing electric vehicle acquisition cost. A reduction in surcharge at the highest IT slab will also benefit high-end vehicle sales. Apart from this, the capital outlay of Rs 10 lakh crore for infrastructure spending will help aid commercial vehicle sales which are already witnessing an upswing. “The overall scenario looks upbeat as of now and it is quite possible that this will be further enhanced once the few stumbling blocks are taken care of,” Singhania added.