VECV’s digital transformation has already touched a multitude of milestones – be it in manufacturing and design leading to higher efficiency, faster decision-making powers, a 360-degree integrated view of complete dealership network or more. In an exclusive interview with N. Balasubramanian, Rajesh Mishra, the Chief Digital Officer of VECV, shares extensively on how the digital transformation has helped VECV in addressing a variety of issues during COVID times.

The digital journey for VECV began around 2012 with the help of Volvo and WABCO. By digital landscaping its manufacturing and design, VECV has developed a strong roadmap on mobility and connectivity. And today, it has proven to be a smart move – especially in COVID times when the necessity for digitalization is at its peak.

And, the best part is that VECV is able to already transfer the benefits of digital transformation to its customers.

Excerpts from the interview:

How has VECV leveraged digital technology on the sales and service fronts especially post COVID?

About 18 months prior to COVID pandemic, we had begun running a few major programs such as retail excellence, uptime, and drive on competency, internally from BS 6 perspective and created digital infrastructure, though digitalization of the whole ecosystem of the front end was begun even earlier, in 2015-16. It is called the Udaan platform, a dealer business management solution app. Under this, we developed multiple tracks for competency of our dealerships, their upkeep, aftermarket structure, uptime or any product related issue.

Since we had the ground work ready, we could quickly shift to a virtual platform during COVID. From sales, service, and operational competency to the mechanics – all were engaged through our mobility ecosystem. We have also developed a few smart phone apps such as SalesOne Value Selling, and EnAct app.

On the customer side, we have created a few more platforms – e-demo, e-meet, e-pitch – to be able to demonstrate the product, channelize the interest and lead management framework right up to the dealership salesperson, in an effective fulfillment process.

We also engage with asset aggregators, and completely integrate the customer footfalls on their platform into our ecosystem, so that the visibility of the prospective customer is high in the organization. Keeping COVID in mind, we have introduced contactless operation through WhatsApp Enterprise. We have also introduced digital payments to avoid physical exchange of money, and even AMCs and insurance are on the digital platform now. Primarily, mobility and analytics have helped us to spin the operations around and everything is well integrated with end-to-end visibility.

How much of a role will digitalization play in the aftersales business?

Aftermarket is process driven. The more there is standardization and setting up of the processes, the better will be the aftermarket because in this we typically deal with many small dealerships. And with this comes digitalization.

Our predictive analytics is wholly available to our dealership and our aftermarket team as well to be able to create improved differentiation of services. We are able to gauge beforehand the types of repairs and parts these vehicles require, be ready with bays, technicians who have the required competency and the parts.

We have now rolled out pan-India service planning and reminder system also. This ecosystem is completely analytics-driven based on service history, and call record response. We are working towards generating more organized and scheduled customer footfall into the workshops with better planning from our side. So that is the convergence we are looking at.

What is the customer feedback on your 100% connected vehicle solution? How much value proposition are they actually seeing?

VECV was the first to launch telematics in 2012-13. Usually, OEMs see telematics as a product feature only. But we have created a connected services ecosystem which is where the differentiation lies. Prior to launching 100% connectivity, we established a few key props – uptime, customer advisory, partner solutions, and API data integration. We conducted extensive customer research in light-, medium- and heavy-duty segments to understand their operations, challenges, fuel consumption, their driver performance.

We analyzed during our customer interactions that they need more insights which cannot be offered as reports, they need to be made to understand what action to take, and that many large fleet operators in heavy duty vehicle segment have already established their own ecosystems in operations. It means that they cannot be expected to work on different devices or portals. They need an API ecosystem where the data can be pumped into their systems.

Then, in analytics-led customer value, we identified broadly 4-5 areas like trip management, fuel pilferage, trip and driver behavior, and fleet scorecard where we developed most of the analytics and started piloting with our customers. Now we have started working on data monetization. This is helping us to drive benefits to customer.

We are looking at new concepts like driver marketplace which is an offshoot of connected services initiative. Under this, we train the drivers and also source the right driver for our customers with the help of a few startups. We believe that this is the way forward because driver as a commodity with advanced trucks will become more of a reality soon.

How is digital transformation progressing on the supply chain front?

There are two aspects of supply chain and one is from the customer perspective which has mostly to do with spare parts supply chain. It is gaining tremendous focus in the organization – right from setting up the advanced warehouse, and digital systems to move parts forecasting to consumption base. The challenge lies in integrating the point of consumption that is retailer to supply into one unique ecosystem by which any conjunction happening anywhere gets flashed through a process and gets hooked on to the supplier for urgent supplies.

VECV has the largest product range with almost 60,000 active parts. With BS 6 active and new vehicles running, incidences of downtime happening will take time. So, we are building analytics into it and trying to document the behavior of a vehicle in a particular segment and extrapolating it with pan-India scenario and trying to predict the kind of volumes and parts that will be required in future. So, we are moving from a typical dealer order-based business to prediction-based business and plugging it into our warehouse operation so that we are more prepared to handle such requirements.

On the vehicle side, we were running a program called Project Lakshya on supply chain automation using basic technologies like RFID and QR code, and we could bring considerable improvement in our material visibility – right from the supplier to local warehouses. Then, on the line supply, gateway supply and on demand planning fronts too, we have executed automation. But demand planning has taken a hit due to BS 6 transition and COVID. On the supplier collaboration, and supplier risk management fronts, we are using an open SaaS platform. During COVID times, it has helped us to judge the risk profile of our tier 2 and 3 partners who are across the globe and to be able to plan our production schedule better.

What is your stance on the use of digital solutions in product design and development?

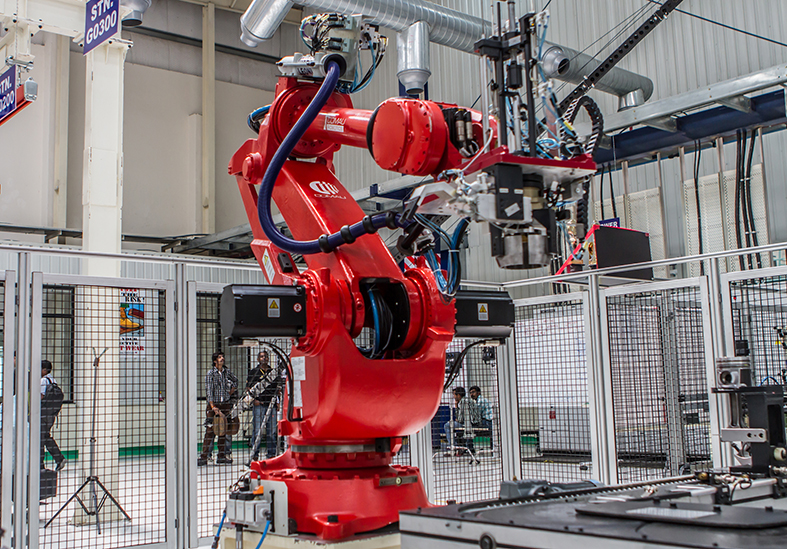

Manufacturing validation happens simultaneously when the product is being validated by the engineering department. Today, we prototype every product multiple times which saves cost also. So, all this is happening for us seamlessly – operating on one single platform called integrated data management or IDM.

There are four stages of digital continuity, which bring down engineering change management time by more than 40%. Over that, we built simulation and validation both for manufacturing and design. We are able to perform the variant development fast. Currently, we are working on how to move on to more customized requirements. We have achieved the first three stages. Soon, we will have the capability to allow a customer to configure his vehicle and then we can actually tell the lead time for manufacturing for the vehicle and internally we can organize everything in the manufacturing and supply chain. And we plan for it to be completed this year. We will start with buses first, then trucks because buses have a higher requirement for customization.

What does the current digital infrastructure at VECV look like?

Our approach is to look at technology and the relevant companies, and see how well they can be integrated, create a program, bring all stakeholders together, create organizational transformations. For instance, we have created a key account management program where we have almost 70 people identified in aftermarket, sales and marketing departments, who together have done 288 account identifications covering around 20,000 trucks where we will run our customer experience platform. Now we are building one more platform for our back end which includes quality manufacturing, supply chain and finance, a typical SAP landscape.

For us, technology is the simplest piece in this whole thing. On the network front, we have acquired SD-WAN as technology, and we continue to work on advanced security programs.

During COVID, we had set up VDI (virtual desktop infrastructure) ecosystem for our design teams for them to work seamlessly. But the challenge is that we have many remote plants and mobile network may not be available in all places making virtual validation of the design difficult. Hence, we set up local infrastructure in the main plants where the manufacturing system had to talk to machines real time.

Today, we are one of the most mature manufacturing execution platforms.

Where does the Indian commercial vehicle industry stand in terms of digital infrastructure and digital solutions compared to more mature markets like the US and Europe? And what is the gap that still exists?

On the mobility side, the world is talking about autonomous driving and new technologies but we still need to catch up. India is a cost sensitive market and only when the advantages come to the fore, customers will look beyond cost.

Simultaneously, we have advantages when compared to the Europe and US markets. Adapting technology in the network is a huge challenge there, but in India we can quickly implement, bring it onto common platform and drive digitalization. We already see that with BS 6, we have gone a notch up in our product. We are focusing on aftermarket, customer responsiveness and uptime. And all this has digital content written into it on a vast scale. We know that in the times to come, we will be the biggest and the largest in the CV segment digitally empowered.