By Prabhat Khare

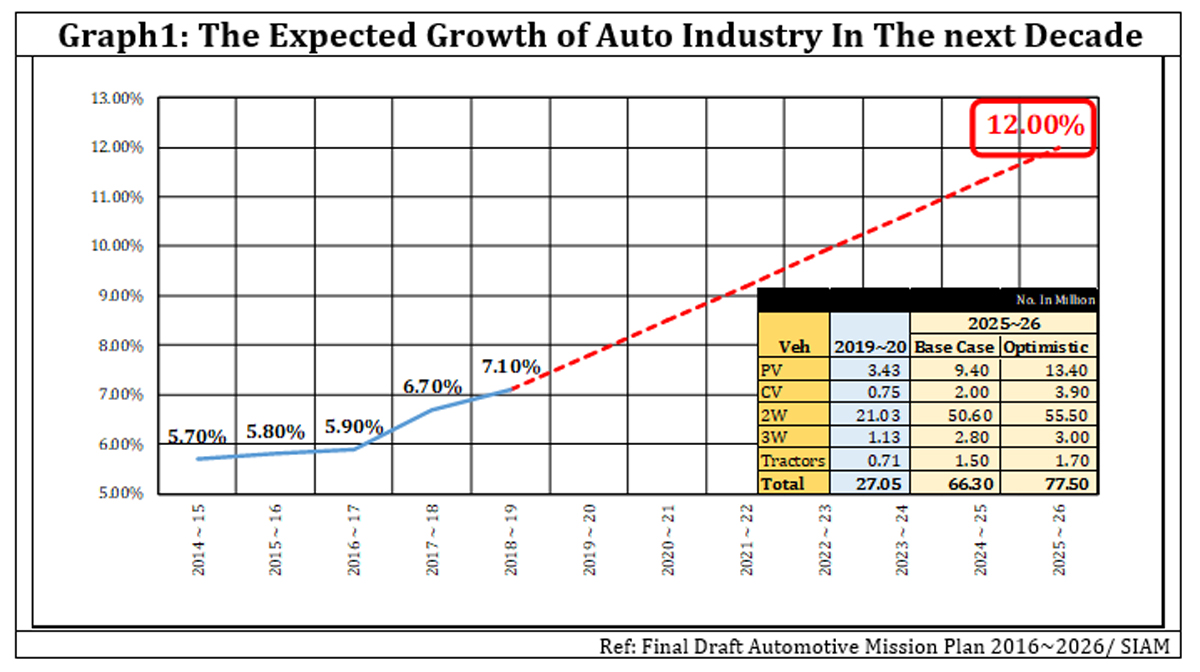

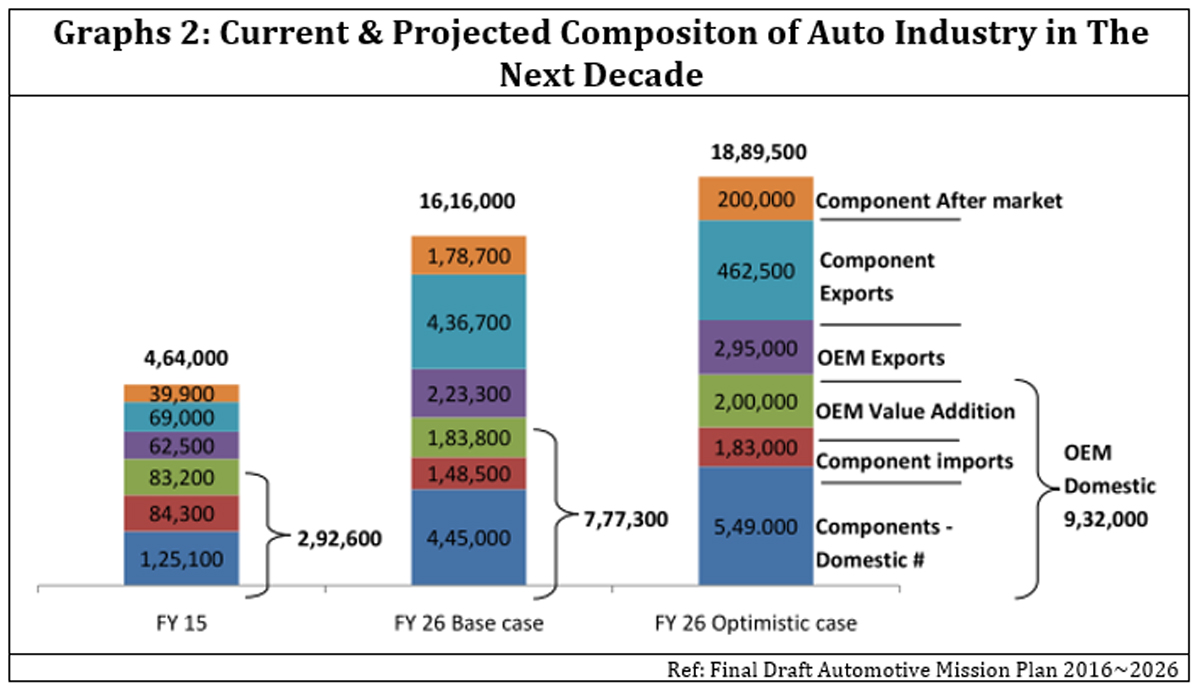

In order to become a USD 5 trillion economy and a global economic powerhouse by 2024-25 as envisaged by our Prime Minister Narendra Modi in 2019, the Indian economy has to grow at a much faster rate than the current rate of ~7%. The Indian automobile industry is the world’s fourth leading manufacturing of cars and the seventh largest manufacturing of CVs as per a survey conducted in the year 2018. While the automobile sector contributes about 7.1% to the Indian GDP, the auto component industry contributes about 2.3% in the GDP. Apart from these hard numbers, the automotive industry offers one of the highest potentials for providing jobs to the youth and the labour force, amongst all sectors Considering these factors, the Government of India is putting a serious effort to increase the current contribution of the auto industry in country’s GDP to 12% and that of auto components industry to 3.05% by 2026. In order to meet this 10 years goal, GoI unveiled the 2nd Automotive Mission Plan 2026 (AMP 2026) at the 55th SIAM Annual Convention on 2nd Sep2015 (The first AMP for the period of 2006~2016 was launched in Dec’2006)). With the implementation of the 2nd AMP, the aim is to bring the Indian automotive industry among the top three of the world’s manufacturer and exports of vehicles & components.

The Production Linked Incentive (PLI) Scheme

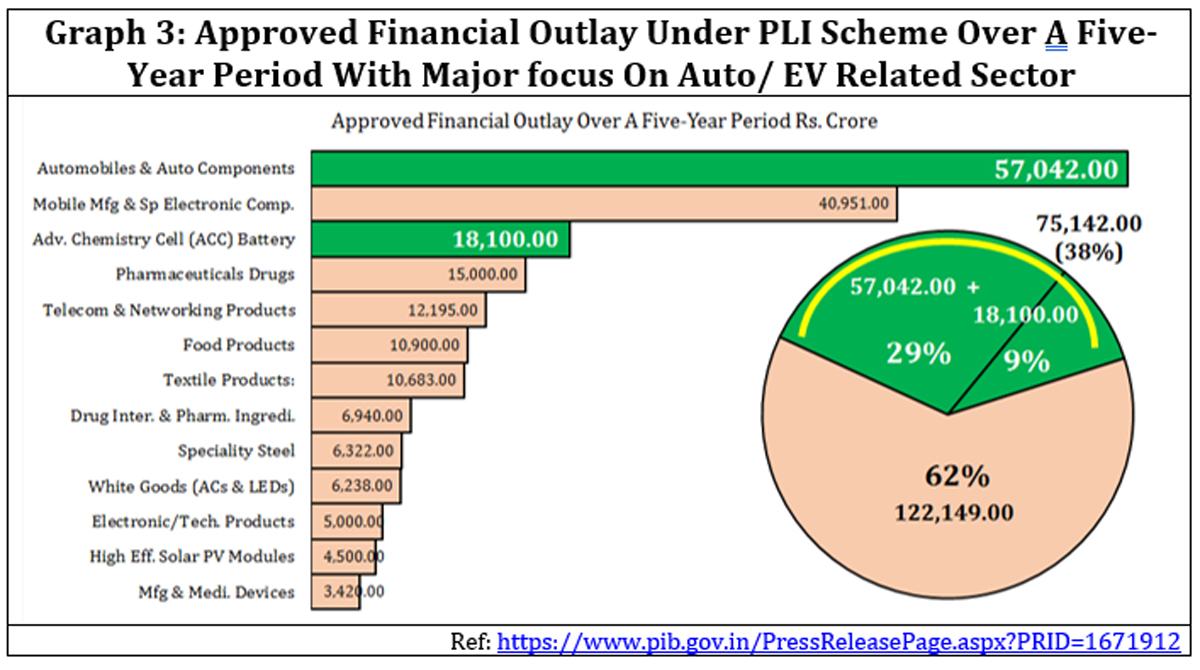

The PLI scheme which was initially notified by GOI on April 01, 2020, to provide financial incentive to boost domestic electronics manufacturing and attract investments however on 12th November 2020, has now been extended to a total of 13 sectors including automobiles and auto components as well as advanced chemistry cell batteries, a must for future EVs. The prime objective of the extending PLI scheme to these 13 critical manufacturing sectors is to make Indian manufacturing, globally competitive by removing sectoral disabilities, developing its own R&D, creating economies of scale, and ensuring efficiencies. PLI scheme is designed to create a complete integrated manufacturing ecosystem in India and make India an integral part of the global supply chains. Initially, the PLI Scheme offered an incentive of 4% to 6% to eligible companies on incremental sales (over base year i.e. 2019-20) of manufactured goods for a period of five (5) years subsequent to the base year however under the revised scheme the manufacturers may expect to get a cashback between 2% and 12% (as applicable) of the incremental sales revenue and incremental exports revenue.

The PLI scheme has come at an appropriate time for the auto sector (i.e. automobiles and auto components as well as advanced chemistry cell batteries) and need to be seen in conjuncture with the “Vision 3/12/65” statement of AMP 2026 (Automotive Mission Plan). Complimenting together, they set a clear path for Indian automotive industry so that it become one of the Top 3 global vehicle manufacturer as well as it also contributes about 12% in Indian GDP, generating additional 65 million jobs by 2026.

Under the scheme, there are four plans for the automotive sector: sourcing incentive scheme, champion OEM incentive scheme, the logistic cost linked incentive scheme, and component champion incentive scheme.

The Scheme is open to any company registered in India which can be a new or existing manufacturing facility at one or more locations in India.

Under the champion scheme, a company would qualify for PLI only if has a revenue of Rs 1000 crore (Rs 100 crore for component makers) from overseas operations, Rs 10,000 crore overall revenue (Rs 500 crore for component makers), and a global investment of Rs 3000 crore (Rs 150 crore for the component sector).

While all three criteria will be required for a company to qualify at Automotive Champions that will offer them maximum incentives in the form of cash backs on incremental sales. For new non-automotive entities, the PLI will be offered to companies that have a global net worth of Rs 1000 crore and have committed at least Rs 2,000 crore investment in India over a 5-year horizon. This investment will have to show a plan for the growth of revenue from automotive and auto component manufacturing.

The total incentive planned for the Automobile industry under the PLI scheme is around Rs 75,142 crore (Rs 57,042 crore are meant directly for Automobiles & Auto Components while Rs 18,100 crore for Advance Chemistry Cell Battery meant for EVs) in the next 5 years, starting from FY23 and ending FY27. Being ~38% of the total PLI amount, this combined amount is the largest pie of the total incentive, indicating the importance & critical role that the Auto industry is expected to play in the growth of the Indian Economy in the coming decade.

Selected Automotive champions will be eligible for a maximum of three of the four schemes while the total incentive per company would be capped at Rs 8,556 crore.

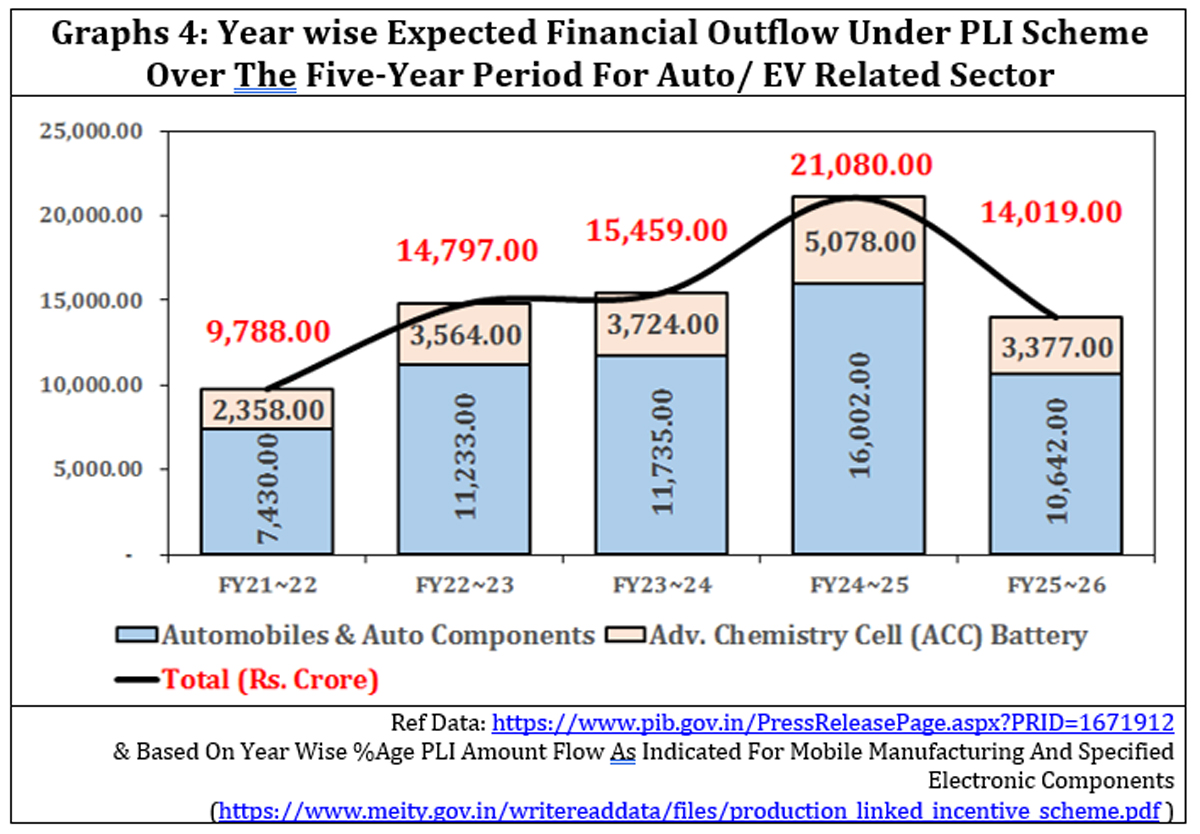

Though the Govt. has yet to come out with the year wise breakup of this amount allocated to automobiles and auto components as well as advanced chemistry cell batteries, for next 5 years, yet by considering the current distribution pattern given for “Mobile Manufacturing and Specified Electronic Components” Sectors we may see the following year wises distribution of the incentive amount allocated to auto industry.

The scheme has set ambitious targets on investment with expectation that PLI would result in additional investment of over Rs 1 Lakh crore over a five-year period with potential for additional employment generation of 58.84 lakh jobs. The automotive industry being a major economic contributor in India’s economy, the PLI scheme intends to make the Indian automotive Industry more competitive which will enhance globalization of the Indian automotive sector.

As the automotive industry offers one of the highest potentials for providing skills to youth and up-skilling opportunities to existing labour force, amongst all sectors, the Auto Sector Skill Development Council (ASDC) which is the apex industry body for skill development under the Ministry of Skill Development & Entrepreneurship, will be playing a critical role in this planned future as an independent testing and certifying agency for automotive industry skills. ASDC need to study the skill gap deficiency in the Indian Automotive industry and take more rigorous actions by modifying the current training curriculum, training the trainers, examination and certification methods.

The PLI scheme is expected to deliver benefits to firms that would meet the eligibility criteria laid under the scheme. However, the real benefits are expected to penetrate inside the automobile value chain and make an impact at each level. The PLI scheme for automobile sector is expected to act as a growth enabler for the auto sector to become a leading global player by becoming cost competitive & becoming one of the top three global auto manufacturers thus attracting investments in R&D, local value addition & creating jobs, which in turn be making India “Atmanirbhar Bharat”.

*****

About the author

The author is Director, KK Consultants, a BE (Electrical), Gold Medalist, IIT Roorkee, Life Member of National Safety Council, a BEE Certified Energy Manager, a Lead Assessor For ISO 9K, 14K, 45K & 50K and an industry expert with work experience at Tata Motors, Honda Cars and Ashok Leyland.

References / Data Sources:

- Graph1: Final Draft Automotive Mission Plan 2016~2026 (https://dhi.nic.in/writereaddata/Content/AMP%202016-26%20Final%20Approved%20Draft.pdf)

- SIAM Data of Automobile Manufacturing

- Graphs 2: Ref: Final Draft Automotive Mission Plan 2016~2026

- Graph 3: Ref: https://www.pib.gov.in/PressReleasePage.aspx?PRID=1671912

- Graphs 4: Ref Data: https://www.pib.gov.in/PressReleasePage.aspx?PRID=1671912 & https://www.meity.gov.in/writereaddata/files/production_linked_incentive_scheme.pdf