Basic HTML Version

80

MOTORINDIA

l

June 2012

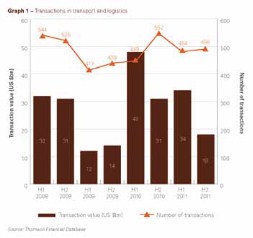

Mergers & acquisitions (M&A) activity in transport

and logistics hit a four-quarter high in the first three

months of 2012, with the underlying drivers of trans-

actions aligning to fuel $27.9 billion of completed and

announced transactions.

The emerging trends suggest that 2012 is poised to be

a year for accelerating global M&A activity in the trans-

port and logistics sector. This activity will be driven by

four factors:

• Significant war chests built up during the economic

crisis are now ready for deployment.

• Strategic and financial investors looking to capi-

talise on emerging trends in high growth niche mar-

kets, including e-commerce, time and temperature

sensitive delivery, and secure courier requirements.

• A need for scale and consolidation in traditional

T&L segments including post, passenger transport

and shipping.

• Growing demand from infrastructure investors

for quality airport, port and road assets.

M&A activity has traditionally been a barometer of

confidence, and on this basis the prognosis is good.

The 2011 and 2010 transaction levels (measured by

value and number) exhibited a return to normality

over the crisis-hit 2009.

Although M&A levels in the second half of 2011

were impacted by sovereign risk-related financing

uncertainty, the new year has hit a higher gear. Although

short-term factors such as further fuel price shocks and

debt market jitters may influence the timing of activity,

it is felt that the imperatives for change are aligned to

drive activity in the medium term.

This report looks at the transactions landscape in

transport and logistics in 2011. It examines the driving

forces behind these trends, which can be characterised

as follows:

• Average transaction values lower than 2010 (partic-

road transportation