Basic HTML Version

MOTORINDIA

l

June 2012

81

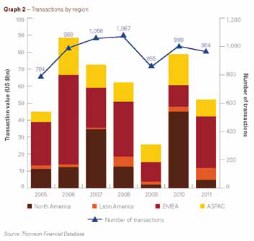

ularly in North America) reflecting the distorting impact

of the $36.7 billion Burlington Northern Santa Fe deal

in the prior year, and the impact of “distressed M&A”

particularly in H211.

• Strong growth in EMEA fuelled by a number of

landmark transactions, including the divestment of TNT

Express for $7.2 billion.

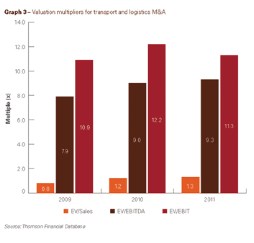

• EBITDA and sales multiples increasing for the third

consecutive year, as EMEA multiples converge.

Reduced speed in second half

As graph 1 shows, the number of transactions in

2011 remained at a similar level to the previous year.

This demonstrates that 2010 was not an exception

and that the recovery from the 2009 post-recession

low point appears stable.

Indeed, the first half of 2011 recorded an increase

in the total value of transactions on the second half

of 2010. The second half decrease reflects the in-

creased uncertainty and reluctance of investors in

the wake of the debt crisis in the European Union.

In value terms, the 2011 average transaction size

was lower than 2010. Although there were large

strategic transactions in the first half of 2011, more

small transactions and bail-outs (“distressed M&A”)

were observed in the second half of the year, de-

pressing average values for the year.

Despite the drop in total transaction values com-

pared to 2010, the mergers and acquisitions market

for transport and logistics remains buoyant. In 2011

M&A transactions totalled $52.1 billion, twice the

equivalent figure in 2009.

The emerging trends suggest that 2012 is poised to

be a year for accelerating global M&A activity in the

transport and logistics sector.

Europe leads the way

The drop in total transaction value in the transport

and logistics sector in 2011 was most pronounced

in the regions of Asia-Pacific (ASPAC) and North

America, as shown in graph 2.

In North America the number of transactions was

stable. However the total transaction value declined

to $4.7 billion from $45 billion in 2010. This was

exceptional in North America, due to the purchase

of Burlington Northern Santa Fe by Berkshire Hath-

away with a transaction value of $36.7 billion. In

ASPAC there was also a (less dramatic) decrease in

transaction value. In Latin America the transaction val-

ue grew significantly, albeit from a low base.

However, the major story is the increase in transaction

value in the Europe, Middle East and Africa (EMEA)

market. Transaction values in 2011 were $30.1 billion

in comparison to $12.7 billion in 2010. The number of

transactions in EMEA was very similar to 2010, indicat-

ing a number of landmark transactions in 2011. These

road transportation