Basic HTML Version

82

MOTORINDIA

l

June 2012

include the divestment of the TNT Express branch

for $7.2 billion; the investment of the French sov-

ereign wealth fund, Caisse des Depots & Consig-

nations, of 26.3 per cent in La Poste SA, with a

value of $2.1 billion; and the sale of 38 per cent in

equity of the Brussels airport to Ontario Teachers

Pension Plan for $1.7 billion.

Valuation multiples of transactions (the ratio of

enterprise value to sales, and EBITDA) during the

last three years have increased. Valuation levels

are now almost at the levels prior to the outbreak

of the financial crisis in 2008. This demonstrates

the increased confidence of investors in the trans-

port and logistics sector, and the renewed appetite

for mergers and acquisitions. Graph three demon-

strates this.

On closer observation, however, there are large dif-

ferences between the individual regions. In EMEA, for

example, the valuation levels are particularly high. A

trend toward increasing valuation levels can also be

seen in North America and ASPAC, albeit somewhat

less dramatic than Europe. Despite an increase in total

deal value in Latin America, the valuation levels are de-

creasing.

In North America and EMEA it can be seen that in

2011, the EBITDA and EBIT multipliers have con-

verged so that they are now almost identical to each

other. This shows that in 2011, a number of key transac-

tions in these regions related to asset-light companies.

Outlook for 2012

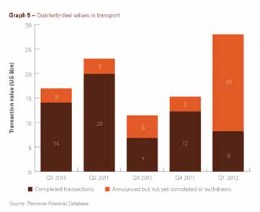

The first quarter of 2012 showed growing M&A ac-

tivities in the transport sector compared to the second

half of 2011. This can be clearly demonstrated in graph

5.

Overall, 177 transactions with a total value of $8.2

billion have been completed. A further 147 mergers and

acquisitions with a total value of almost $20 billion have

been announced in the first quarter of 2012 representing

a significant increase on 2011.

Again, Europe has been the centre of M&A activity,

with the largest number of transactions completed in

quarter 1.

To make this strong start to FY12 sustainable, three

key factors must be taken into consideration:

Confidence in sustainable economic recovery:

This depends mainly on continued market trust in the

solutions to the European debt crisis. Should the eco-

nomic outlook remain stable, business activity could

improve as early as the second half of 2012.

Investment pressure on investors:

The pressure

on financial investors to deliver strong returns is high

following a disappointing year in 2011. However, many

private equity firms are finding it difficult to attract fi-

nancing, and the ability to attract new financing will be

a key factor in the outlook for 2012.

M&A appetite of strategic investors:

The M&A

appetite of transport and logistics firms is often correlat-

ed with their debt capacities. This is higher than in pre-

vious years. In particular, companies in the logistics and

express segments currently have deep pockets and stand

ready for more strategic acquisitions. This has been re-

cently evidenced by UPS’ acquisition of TNT Express.

The key sectors to watch are shipping and logistics.

In the global shipping market, the outlook for the year

is bleak, with overcapacity expected to remain. As a re-

sult, there is likely to be further need for consolidation

through distressed M&A, though the transaction sizes

will be reasonably small.

The logistics market, particularly in Europe, remains

fragmented. Private equity investors looking to invest in

niche markets, and the ongoing need for consolidation

are likely to drive M&A activity in this sector. Should

the trend established in quarter 1 continue, 2012 could

be an exciting year for transport and logistics.

w

road transportation