Basic HTML Version

MOTORINDIA

l

September 2012

11

three-five years.

Players such as Volvo-Eicher

have revamped their product port-

folio with a firm view to gaining

market share in the MHCV seg-

ment. Moreover, India has been

chosen as the global hub for Volvo’s

5 and 8l engines – a move that not

only strengthens India’s global rel-

evance for the company, but also

positively impacts Volvo-Eicher’s

competitiveness within India. MAN

has brought out a new LITE range

of trucks for rated load applications,

while BharatBenz will launch 16

trucks over the next 1.5 years.

Leading Indian players are under

attack not only from a product but

also from a service perspective. New

networks are being rolled out with

considerable speed. BharatBenz,

for example, has rolled out about

70 dealers in the first phase with

a strong focus on southern India

where it intends to challenge Ashok

Leyland’s dominance. Mahindra

Navistar has set up state-of-the-art

dealerships across the country and

invests in service innovations such

as 24x7 hotlines, a 48-hour response

guarantee to get trucks back on the

road, extended warranties and the

like.

With a market contraction and

a lot of new capacity being added

in the market, margin pressure is

likely. Companies will resort to

discounts to achieve market shares.

Even today, discounts in the indus-

try are reported to be in the range of

Rs. 60,000 per truck.

Financial pressures will not re-

main limited to OEMs. With large

new investments and volume pres-

sures coming their way, dealers may

find their viabilities challenged as

well.

The winners in this complex and

challenging environment will be

companies that combine strong cost

focus, superior execution capabil-

ity and relentless focus on customer

needs. Cost and superior execution

are vital to protect margins in an

environment in which escalating

input costs and investments as well

Roland Berger

Strategy Consultants

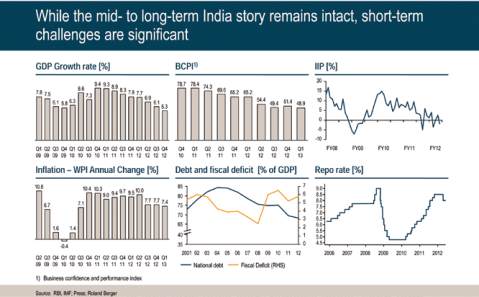

Figure 1

Established companies such as

Tata Motors and Ashok Leyland

react with product offensives

of their own. While Tata Mo-

tors announced investment of

about Rs. 2,000 crores, Ashok

Leyland will invest about Rs.

800 crores.

auto industry